Why Did Your Credit Score Drop And How to Fix It 2024

Sky Blue | The Ultimate Choice to Fix Credit

✓Faster Disputes on Hard-to-Spot Issues

✓Credit Score Monitoring

✓Tailored Credit Optimizing and Repair

Small drops in your credit score are completely normal, but big drops might indicate serious problems like identity theft. So it’s necessary to monitor your credit regularly and notice any potential issues. To help make this exhausting and time-consuming task less so, we do have some tools to protect you against potential threats easily.

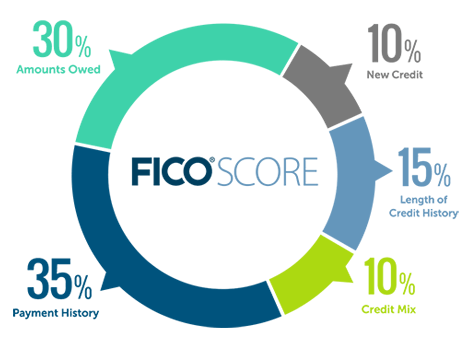

What makes up your credit scores

Knowing what makes up your credit scores will help you understand how and why they change over time. For example, the FICO scores, commonly used by lenders, are determined by:

- Payment history (35%)

This is the most heavily weighted factor, reflecting whether you’ve paid past credit accounts on time. - Amounts owed (30%)

This is how much debt you carry. If you have high loan balances relative to your credit limits, you might be considered a risky borrower. - Length of credit history (15%)

In general, longer credit history is having a positive effect on your credit scores. - Credit mix (10%)

Having different types of credit accounts can be seen as a good thing, including credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans. But it’s not necessary to get one of each. - New credit (10%)

Applying for several new credit accounts in a short period represents a greater risk.

What might trigger the drop? (And how to fix)

Your credit score is a numeric representation of your credit report, meaning that it’s a reflection of your credit reports. If there’s just a mild drop, no need to panic. Multiple factors might trigger the change. Besides, scores provided by different scoring companies might be slightly different, because they don’t use the same scoring model.

However: If you’ve noticed any big credit score drops and you recently didn’t do anything special, something must be wrong. Either there’s a mistake in your report, or you have fallen prey to identity theft.

Listed below are some common reasons that might lower your credit score. Use it as a checklist to troubleshoot any possible problems.

1. There is a new derogatory mark on your credit report

Derogatory marks are negative items in your credit reports, including late payments, charge-offs, tax liens, lawsuits, bankruptcy filings, and more. They’ll remain on your reports for 7 to 10 years.

Fix: Verify its legitimacy. If it’s a mistake, contact the credit bureaus to dispute it. Or resort to Aura’s 24/7 assistance team for help, if you’re a subscriber.

2. You missed a payment

According to FICO, payment is the most important factor in its scoring model. If you were just a few days late on a payment, no big deal. But if it’s over 30 days, card issuers will report them to the credit bureaus, which might hurt your score.

Fix: Try automatic payments if you have multiple credit cards or loans.

3. You’ve recently opened several credit cards

When you open several credit accounts in a short period, you represent more of a risk to lenders. Besides, when you’re applying for a new card, the issuer will make a hard inquiry on your credit report, which might lower your score temporarily.

Fix: Avoid opening several accounts in a short period of time.

4. You closed a credit card

That would shorten the average age of your credit accounts. As your credit score is based partly on the length of your credit history, a shorter history can lower your credit score.

Fix: Consider if it’s really necessary before canceling a credit card.

5. You’ve spent more than in the past (hence a higher utilization rate)

Spending more than usual months will increase your credit utilization rate. FICO also considers it extremely influential in its scoring model. If you spent more than usual months, it will increase your credit utilization rate, which might cause your credit score to drop.

Fix: Keep your credit utilization rate below 30%.

6. There’s an error on your credit report

There might be mistakes on your credit report. That’s why you need to check your credit report regularly to identify any suspicious activities or transactions you don’t recognize. You have the right to get free copies of your credit report from AnnualCreditReport.com each year (now once per week until December 31, 2023).

Fix: If you find an error, dispute it with the credit bureaus.

7. Your identity has been stolen and misused

This is the most tricky one – someone might have stolen your identity and made transactions, opened new cards, and even commit fraud in your name, then cause your credit score to drop. In fact, the simplest way to notice that is to check your credit report for any irregularities. If there are suspicious items that you don’t recognize, you might need to check for identity theft.

Watch out for identity theft

Your credit history may show negative remarks after an identity theft event, which will decrease your credit score. Unfortunately, identity theft usually happens in silence. By the time you notice something weird, the damage will probably already have been done. That’s why you need to regularly check your credit-related info, like credit reports, bank statements, bills, and more.

If that sounds troublesome and exhausting, you can try Aura, the #1 rated identity theft protection service that offers a one-stop solution for identity protection.

Credit monitoring

Aura monitors the 3 credit bureaus and will alert you if someone tries to access your credit to take out loans or open bank accounts in your name. It also detects your personal information, registered accounts, and credit for any potential threats.

Fraud alert

Aura alerts you of any suspicious activity on your bank, retirement, and other financial accounts. Also, if it detected someone using your SSN to open a bank account in your name, you’ll receive an alert.

Recovery

Aura’s White Glove fraud resolution team will create a step-by-step remediation plan to help you recover your identity in case of a data breach. They are reachable 24/7/365.

Dark Web Scan

Criminals buy and trade your personal information on the Dark Web, which can be used to steal your identity and your money. Aura scans the Dark Web to check whether your password, SSN, bank account numbers, and other sensitive information are there to be sold.

Has your personal data been leaked to the Dark Web?

Credit: Image by Mikhail Nilov and Anna Shvets from Pexels

View all of Arlee Hu's posts.

View all of Arlee Hu's posts.