How to Lock Credit – Protect Yourself from ID Theft

Identity theft is a growing problem in the U.S. If you’re concerned about being a target or you feel more comfortable having more control over your credit files, locking or freezing your credit are both good ways to take.

In this post, we’ll show you the key differences between a credit lock and a credit freeze, how to lock your credit with the three major bureaus and measures to take to protect your identity.

Which Do You Need: Credit Lock Or Credit Freeze

Both freezing your credit and initiating a credit lock are ways to protect your credit when you fall victim to identity theft or you’re concerned about being targeted for identity theft. But they differ in some respects.

A credit lock is a product provided by a credit bureau. It allows you to restrict access to your credit reports so unauthorized people won’t be able to access your credit file and lets you lock a certain card to deter anyone from using it when it’s lost. You can lock or unlock your credit reports from your computer or mobile device, at any time. Basically, a credit lock gives you easier control over your credit report.

A credit freeze also helps you restrict access to your credit reports. If you’re a victim of identity theft or your information has been compromised due to a data breach, freezing your credit is a smart step to take. But it can be inconvenient in some cases since you can freeze and unfreeze your credit with a finger swipe on an app. For example, you’ll need to go to the bureau’s website and use the account you used to place the freeze to unfreeze your credit when you want to apply for credit.

In general, a credit freeze is free at each bureau and is mandated by federal law, but it’s less convenient. While a credit lock offers more convenience, it often charges a fee and provides fewer legal protections.

How to Lock Your Credit

You can lock your credit with each of the three bureaus, but depending on which credit bureau’s service you opt for, it might charge a monthly fee:

- Equifax’s Lock & Alert offers locking of your Equifax credit report and alert for free.

- TransUnion Credit Lock Plus is a paid service that lets you lock your TransUnion and/or Equifax credit reports.

- If you use the locking service from Experian, you can get it for free for a month, then it will charge you $9.99 per month.

You can sign up for a credit lock at each bureau’s website, or download the respective app to lock or unlock your credit report.

Other Ways to Protect Your Credit

There is no fail-safe way to prevent identity theft, but there are methods that can help you reduce your risk of identity theft and minimize damage.

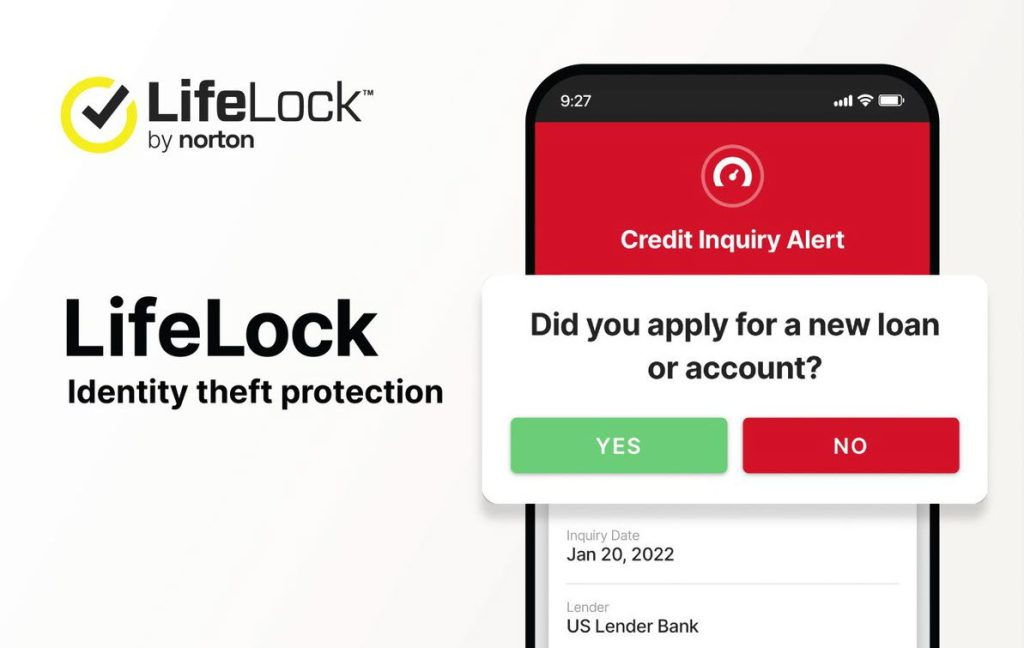

1. Use Identity Theft Protection

If you don’t already have a way to regularly monitor your credit and personal information, consider signing up for an identity protection tool.

Identity theft protection services help you prevent identity theft by monitoring your credit and the dark web, alerting you when your private information gets leaked, and recovering your identity if you fall victim to identity theft. And most of them offer identity theft insurance

Best Identity Theft Protection Services

Provide a clean user interface and affordable packages for comprehensive protection.

Most affordable identity theft protection service with over 40 years of experience in identity recovery.

Powered by IBM Watson AI with real-time threat alerts and personalized risk assessments.

SSN and credit alerts, dark web monitoring, and alerts on suspicious activities with your ID and credit card.

2. Stay Alert to Phishing and Spoofing

Phishing websites mimic banking and other sensitive sites to lure people to fill in their credentials. And some scammers make phone calls appearing to come from businesses or government entities, asking for your personal information. Instead of giving your information, ask why it is needed and how it will be protected. If you have any doubts, initiate a callback yourself.

If you get emails and text messages that contain links or attachments, even if they are from someone you know, don’t click the links or files before you are sure the URL is correct and the file is safe.

3. Use Strong Passwords

Many people tend to use the same password for multiple accounts, which can put all your accounts in a risky place when one of them is compromised in a data breach. When hackers and identity thieves get hold of one of your login credentials, they’ll try it on other sites quickly.

So make sure you use unique passwords for each site, and use a password manager like Dashlane to keep them straight.

4. Secure Your Documents

Keep your documents in a secure location, like your social security card, tax return and birth certificate. For bank statements, bills or other documents that contain your personal information, shred them before throwing them in the trash.

5. Enable Two-Factor Authentication (2FA)

Two-factor authentication is a security measure that requires both your master password and another form of identification such as a code received on your phone to access your online accounts.

It adds an extra layer of password security and makes it harder for identity thieves to log into your account.

6. Review Your Credit Reports

You can get one free credit report from each of the three major – Equifax, TransUnion and Experian every year.

All you need to do is visit AnnualCreditReport.com and make your request online. But make sure you take advantage of this perk wisely and get one report at a time, four months apart. This way, you can monitor your credit report throughout the year.

7. Remove Your Digital Footprint

Data brokers collect personal data by crawling online sources and public records, and they sell it to anyone willing to pay.

Even if you’re not online, you might still find your personal information publicly available online, such as your address, phone number, and email address.

If you find your information on some website you don’t want it to be on, contact site owners to get it removed, or try a privacy service like DeleteMe to remove you from data broker sites.

View all of Ellie Zhuang's posts.

View all of Ellie Zhuang's posts.