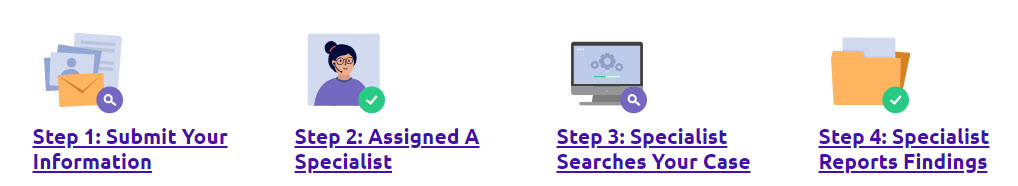

5 Common Venmo Scams To Look Out For – 2022 Tips

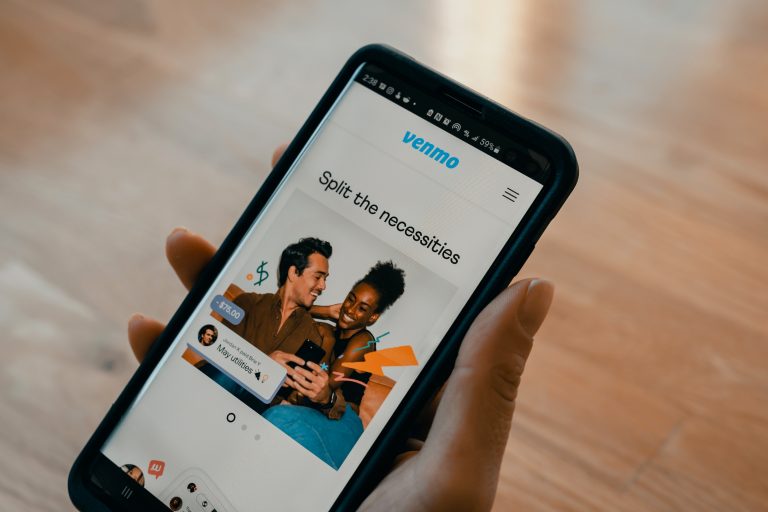

Venmo is a digital payment service and was originally designed for money transfers between friends and family. Splitting bills and rent has never been easier! As the needs vary, nowadays many people use Venmo for online transactions or small businesses.

But with anything related to money, scammers are always near. Even if you don’t use Venmo a lot, you could still get scammed on Venmo. After all, there’s never “too careful” when it comes to money. In this post, you’ll learn about the common Venmo scams and how to avoid them.

Common types of Venmo Scams

There are a few types of common Venmo scams and you need to be extra cautious of them.

Text phishing

Text phishing

Phishing is a term for email scams. People receive emails under a reputable company’s name and are asked for personal information, such as passwords or credit card info. Text phishing, also known as “smishing”, is the practice of asking people to reveal such information via text messages.

These fraud texts usually contain a link. When you click on the link, you may be asked to enter your bank account or credit card information to claim a reward. Or, you may be asked to enter your credentials to verify your account.

Calls pretending to be from Venmo

Calls pretending to be from Venmo

Scammers would call you, pretending they’re from Venmo, and claim that you need to verify your account. They might send you a verification code and ask you to provide it, then they could log in to your Venmo account with your phone number.

In some cases, these crooks also claim that they’re from Venmo support and need to charge you some fees before they can proceed to assist you.

Fake sale

Fake sale

When you buy something from a stranger, they might ask you to pay first or send you fake shipping information without actually sending you the item.

If you’re selling, a buyer may tell you that the payment is secured at Venmo’s server. You’ll need to ship out the item to get the payment, once the buyer confirms delivery. This may sound reasonable, but Venmo doesn’t provide such a feature. It’s just another scam.

In addition, it’s also common that scammers use stolen credit cards to send you payment or fake a screenshot of completed payment. In both cases, you won’t be getting your money but losing your item for not

Fake paper check

Fake paper check

A scammer may send you a fake check with the amount exceeding what you should’ve been receiving. Then they might ask you to return the extra amount via Venmo because they need money on Venmo and this way is faster. When the bank figures out the check is not legitimate, the amount will be deducted from your account and you might even get in trouble for it.

This kind of scam is somehow obvious, because the whole thing doesn’t make much sense. But still, you can’t be too careful when it comes to money.

Wrong transfer

Wrong transfer

You may notice mysterious money just added to your Venmo balance. Then you may get a message from a stranger, saying that they misspelled the username or whatever, and pray for your kindness to return the money.

This type of scam usually involves the use of stolen credit cards. Scammers Venmo you from a stolen credit card, and ask for money returned before the card owner reports to the bank. If you transfer the money back to the scammer’s account, they’ll instead link their own card to the Venmo account to receive the money, or try to cash out ASAP.

How to protect your money and avoid Venmo scams

Now that we covered the common types of Venmo frauds, you can look out for those suspicious signs and protect your finances online. But scammers never get tired of coming up with new ideas and stealing people’s money. Here are some general tips you can follow to avoid Venmo scams:

Don’t reveal your personal info outside of Venmo

Don’t reveal your personal info outside of Venmo

Within the Venmo app, it’s safe to link your card to your account and transfer money. But never give out your bank information or credentials to so-called Venmo staff or on suspicious websites. If you need to contact Venmo support, make sure you directly go to Settings >> Get help on the Venmo app.

Also, note that only the email addresses ending in “venmo.com” or “email.venmo.com” are actually from Venmo. If you get an email using Venmo’s style and fonts but not from the above email addresses, it’s probably a fraud. Never reply to such emails or spooky texts.

Only transfer money to people you actually know

Only transfer money to people you actually know

As Venmo’s originally designed for, we recommend you only use it for paying people you know and trust. Although Venmo’s social feed (now called “stories”, which is your friends’ transactions appearing on your homepage) is fun and has made this app more than a digital wallet, cybercriminals could also make use of it.

If you’ve been using Venmo for some time, you may have noticed that the global feature of the social feed is now removed from the app. It’s said to improve security and prevent scams. On your homepage, you can only see transactions within your friends’ circles.

Research the person you’re trading with

Research the person you’re trading with

When you need to Venmo a stranger, such as trading with an online buyer/seller, do it safely. You can research the person you’re trading with just with their username.

By using people search tools, you can look up the person to see if anything seems off or the identity looks fake. Below are some legitimate people search engines that we recommend. Note that these are paid services, but you can sign up for their trials.

Bonus tips:

If you happen to know the person’s name, number, or email address, you may get a more precise result from the people search.

For example, if you’re trading with a Facebook user, you probably know their real name. Or, if you’re selling concert tickets, you’ll need the email address (or sometimes phone number) associated with the account you’re transferring tickets to.

In addition, you can mark the Venmo payment as a goods or service transaction. It may result in a small number of extra fees, but if anything goes wrong, you’ll be able to dispute.

Stay safe online

Stay safe online

It’s important to keep your mobile wallet safe. We recommend using a VPN, especially when you’re conducting online transactions or using public Wi-Fi. A VPN can hide your IP address and encrypt your web traffic, so your online activities remain anonymous and secure.

That’s all for this post! We hope this post has explained how to recognize and avoid Venmo scams clearly. If you have any thoughts that you’d like to share with us, feel free to drop a comment down below!

Credits:

Photo by Tech Daily on Unsplash

Icons made by Freepik from www.flaticon.com

View all of Katie Yan's posts.

View all of Katie Yan's posts.