5 Best Budget Apps To Track & Save Your Money (2024)

Managing finances can be overwhelming and time-consuming. You’ll need to set a budget for different categories of spending, track expenses and income manually, and adjust your financial plan. But with a budget app, the whole process can be very easy and enjoyable. Apart from tracking your bills automatically, budget apps today can do a lot of things to help you reach your financial goals effectively and freely.

1. Rocket Money

– Best for saving money

Rocket Money, formerly known as Truebill, is one of the best budgeting apps owned by Rocket Company. With an aim to empower its users to save money, spend less, and see everything, it’s estimated to save more than 5 million members $245+ million over the past 5 years.

Rocket Money includes a variety of useful features. It monitors your spending by categories, analyzes transactions with in-depth insights, and allows you to build a budget and financial goals with ease. You can also view your credit score and history as well as your net worth and be notified of any important changes.

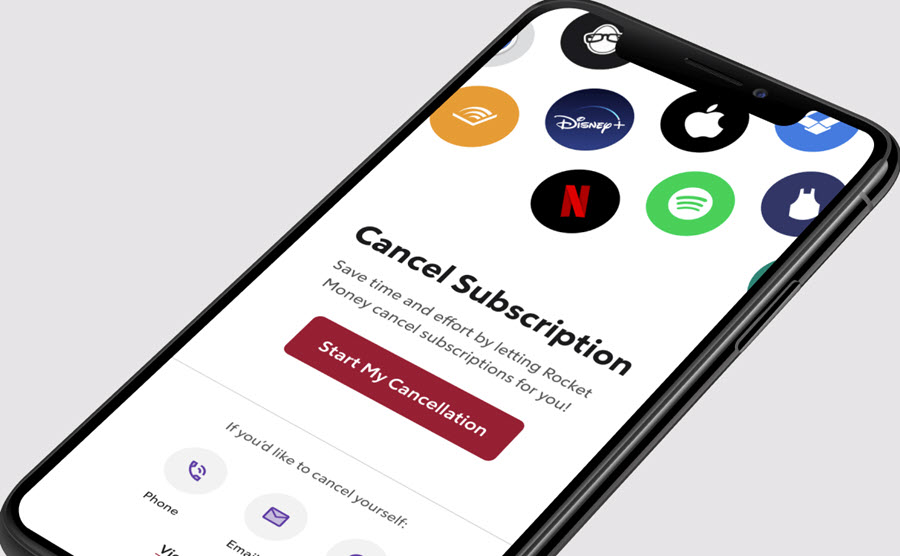

Besides, it explores every possible opportunity for savings. It may cancel subscriptions you’re no longer using or have forgotten, negotiate better rates on your phone, Internet, or cable bills or insurance, and request refunds on overdraft or late fees.

Pricing:

Basic: Free (Financial tracking, credit score monitoring, account alerts, two budgeting categories, and bill negotiation.)

Premium: $3 – $12/month (Premium includes basic functions as well as premium chat, subscription cancellations, custom categories, unlimited budgets, smart savings account, and more.)

Ratings:![]() 4.3 – 50K+ reviews

4.3 – 50K+ reviews

2. Simplifi

– Best for beginners

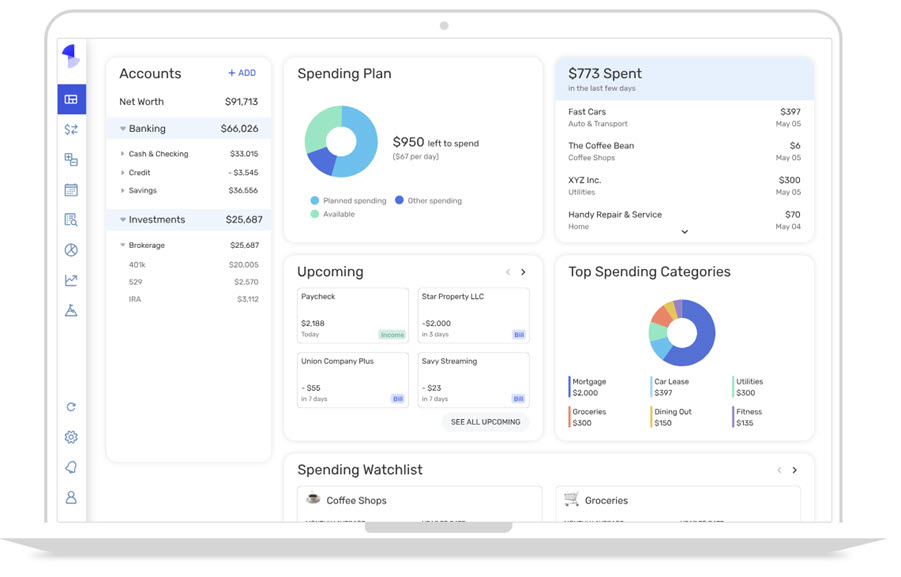

Simplifi by Quicken is a great personal finance app that combines intuitive design with comprehensive features, just as its name suggests. After connecting your banks, credit cards, loans, and investments to the app, you’ll gain a full picture of your financial life in one place, which not only cover balances and transactions across your financial accounts but also project your cash flows so you can plan ahead.

Meanwhile, Simplifi supports budgeting with high-level personalization. You could enable automatic monthly contributions to your goals, customize transactions with tags, or create watchlists for certain categories or stores to better understand where your money goes.

Pricing: $2.39/month (30-day free trial)

Ratings:![]() 4.1 – 1,847 reviews

4.1 – 1,847 reviews

3. Monarch Money

– Best for couples and families

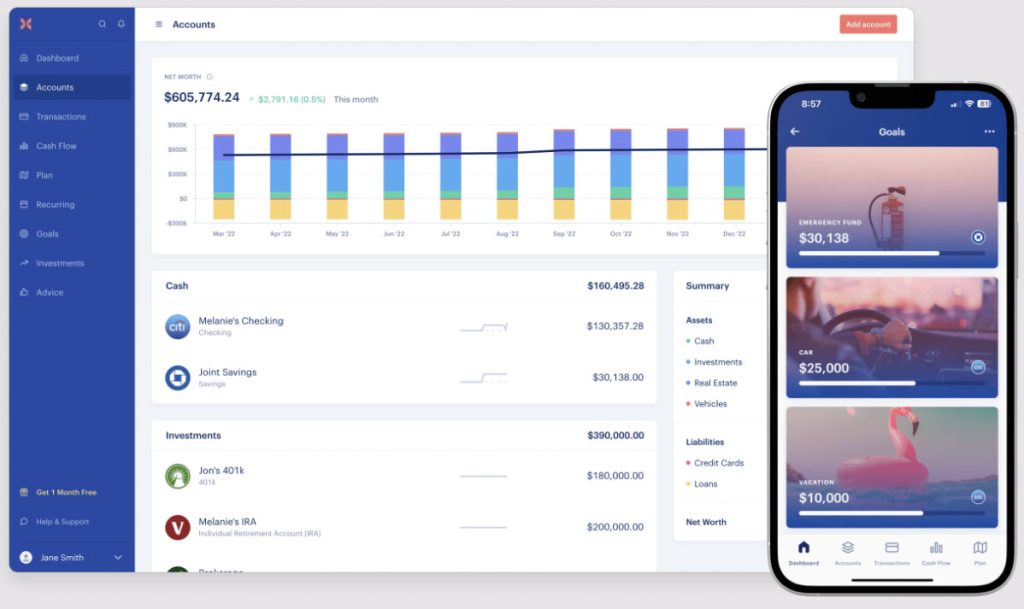

Monarch Money is an all-in-one platform that brings together everything you need to optimize your finances and achieve financial wellness. It gives a clear and automatic breakdown of how you spend every dollar and helps you plan for larger financial goals.

Beyond just tracking balances of financial accounts, Monarch Money is adept at tracking assets and debts. It incorporates a powerful portfolio analysis tool, which can chart your allocation, compare your investment holdings by key benchmarks, and identify which performs the best.

This app is also a perfect and cost-efficient choice for people who want to budget with their partners or families. You could invite unlimited collaborators to your household, where each of you will get a login and have a shared view of the joint finances and saving goals.

Pricing: $14.99 (7-day free trial)

Ratings: 4.8 – 2,535 reviews

4.8 – 2,535 reviews

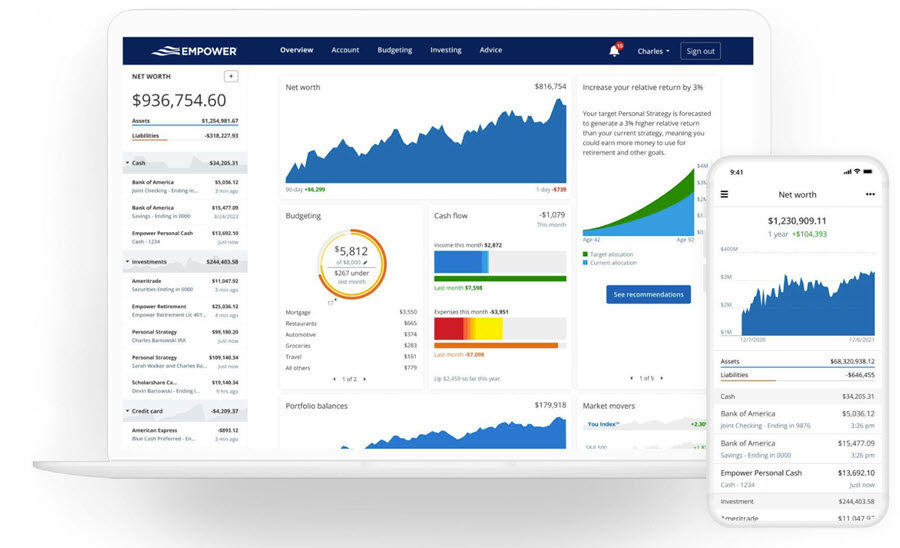

4. Empower

– Best for tracking investments

Empower, formerly Personal Capital, is a free app for people to calculate their net worth, track investment accounts, and build financial plans. Offering a wide range of features, it monitors your spending automatically while letting you create budgets or saving goals and stay on track. And the Savings Planner delivers ultimate plans for your retirement, emergency fund, and debt payment.

This tool is most known for its sophisticated health management and investment checkup. It will provide deep insights into your asset allocation and analyze your portfolio risk and performance. You could reach out to their skilled financial professionals and obtain a completely personalized portfolio strategy at a fee.

Pricing: Free

Ratings: 4.7 – 132,850 reviews

4.7 – 132,850 reviews

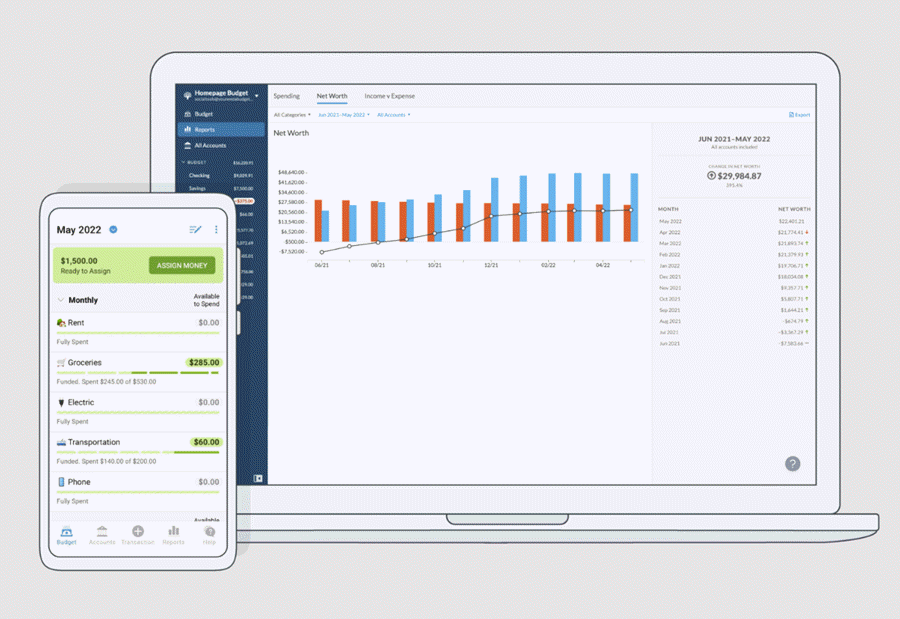

5. YNAB

– Best for cross-platform budgeting

Launched in 2004, YNAB (You Need A Budget) has been one of the most popular budgeting apps. Its users save $600 on average in their first two months or $6,000 in the first year. To get started, you just link your accounts for transactions import, and its smart categorization will learn to sort your spending. Then create your budget plan by assigning the money on hand and prioritizing the categories, etc, and work with it.

What makes YNAB a different and empowering system is its four simple but life-changing rules, which, rather than focusing on what you’ve spent, advocate more proactive zero-based budgeting. The approach may help you gain better control of the money, reduce needs for credit cards and loans, and experience less financial stress.

How does YNAB works

Take a closer look at the YNAB methodology:

Rule One: Give Every Dollar a Job

Assign every dollar you have to a job like paying for utility, groceries, debt, or mortgage. Try to put priority on what you need most.

Rule Two: Embrace Your True Expenses

To determine your true expenses, you may split irregular or non-monthly expenses into monthly payments and also calculate what you’ll need in the future.

Rule Three: Roll With the Punches

Be flexible and change your budget. For example, when you overspend on groceries, move money from another less important category.

Rule Four: Age Your Money

Use last month’s money to pay for this month’s expenses, in which way you’re always ahead and purposeful about spending rather than living paycheck to paycheck.

Pricing: $99/year or $14.99/month (34-day free trial; no credit card required)

Ratings: 4.8 – 45,337 reviews

4.8 – 45,337 reviews

So above are the 5 best budget apps to organize and improve your finances. They vary greatly in features and budgeting systems. To choose a suitable product, think about your financial goals first. Whether you want to track daily spending in a minimalist way, or you look forward to more advanced functionalities. You want to save more through budgeting or need to manage money with your partner.

If you have any questions or suggestions, please feel free to leave a comment below.

View all of Brinksley Hong's posts.

View all of Brinksley Hong's posts.