How to Check If There Is a Lien on a Car by VIN

When buying a used car, you definitely want to check if it has any liens. A lien means someone else, normally a bank or credit union, has a financial stake in the car and the right to repossess the car if the loan is not paid.

Buying a car with an unreleased lien can cause serious problems. Luckily, checking for liens is not that hard. You can usually find out through your local DMV (Department of Motor Vehicles), a vehicle history report, or sometimes right on the title itself. Taking some time to check this out can save you a ton of trouble later on.

Key Takeaways

- The most straightforward way is to look right at the car’s title.

- Pulling a vehicle history report from reputable services like Bumper and EpicVIN can be helpful.

- You can also check with the DMV where the car is registered.

- Contacting the lender directly, if you know who they are, can be a good way to double-check.

Remember: never hand over the cash until you have the title in your hand.

What is a lien on a vehicle?

Usually, there are two reasons why a car has a lien on it.

Most often, it’s because the owner took out a loan to buy it, and the lender holds onto the lien until the loan is paid off. Sometimes, a car can be used as collateral for a loan, too. Either way, an outstanding lien means the bank, credit union, or even a repair shop has a legal claim on the car (they’re called the lienholder), giving them certain rights over the vehicle even though the seller is still the owner.

Liens stick with the car, even if it’s sold. So if you buy a used car that still has an outstanding loan against it, you might end up being held responsible for the loan, or you won’t be able to register the car in your name as shared by a customer1, and worst case scenario, the lender could repossess the car, even though you paid for it.

So it’s crucial to make sure any lien is paid off and released before you buy the car.

Method 1. Check for the title itself

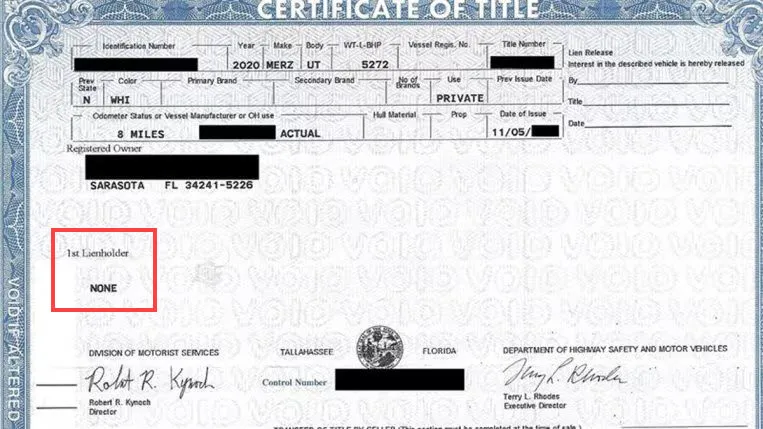

One of the easiest ways is to look at the car’s title. When buying a used car, you can ask to see the title, whether it’s a paper title or electronic.

In many states, like California, Alabama, and Florida, the title itself clearly indicates lien status. Look for a designated section for the lienholder. If this section is blank or says “None”, there’s no lien, and you’re in the clear. However, if it lists a bank or credit union, it means there’s an active lien, and the seller needs to provide a lien release document as proof that the loan has been paid off.

In some other states, the process is different. The lender typically holds the title until the loan is fully paid. So, if the seller claims they don’t have the title in hand, it often signifies an existing lien. While this doesn’t definitely mean you shouldn’t buy the car, it does require further investigation.

When you finally get your hands on the title, there are a few things to watch out for:

- Be wary of any excuses for not having the original title, like “I lost it”. You should ask them to get a duplicate title before your purchase.

- Carefully check the title for any alterations as a forged title is a serious problem. And always, always make sure the VIN (Vehicle Identification Number) on the title matches the one on the car.

- Check with other sources if anything seems suspicious or you’re just not sure about the title. You could contact your local DMV or run a vehicle history report. These reports can tell you a lot more than just lien information, which we’ll talk about next.

Method 2. Pull a vehicle history report

A vehicle history report offers a quick and easy way to check for liens, especially if you haven’t got ahold of the title or contacting the DMV isn’t feasible right away2. It’s a comprehensive overview of the car, providing a summary of its history, including accidents, title changes, and importantly, liens.

Not all vehicle history reports are the same. For more reliable information, choose a service approved by the NMVTIS (National Motor Vehicle Title Information System). The NMVTIS database is a national repository of title information, but it’s only accessible through its approved providers, so selecting a reputable service is crucial.

While services like CARFAX and AutoCheck are well-known, they tend to be geared towards dealerships and can be pricey. For individual buyers, a more budget-friendly NMVTIS-approved option like Bumper is a decent choice:

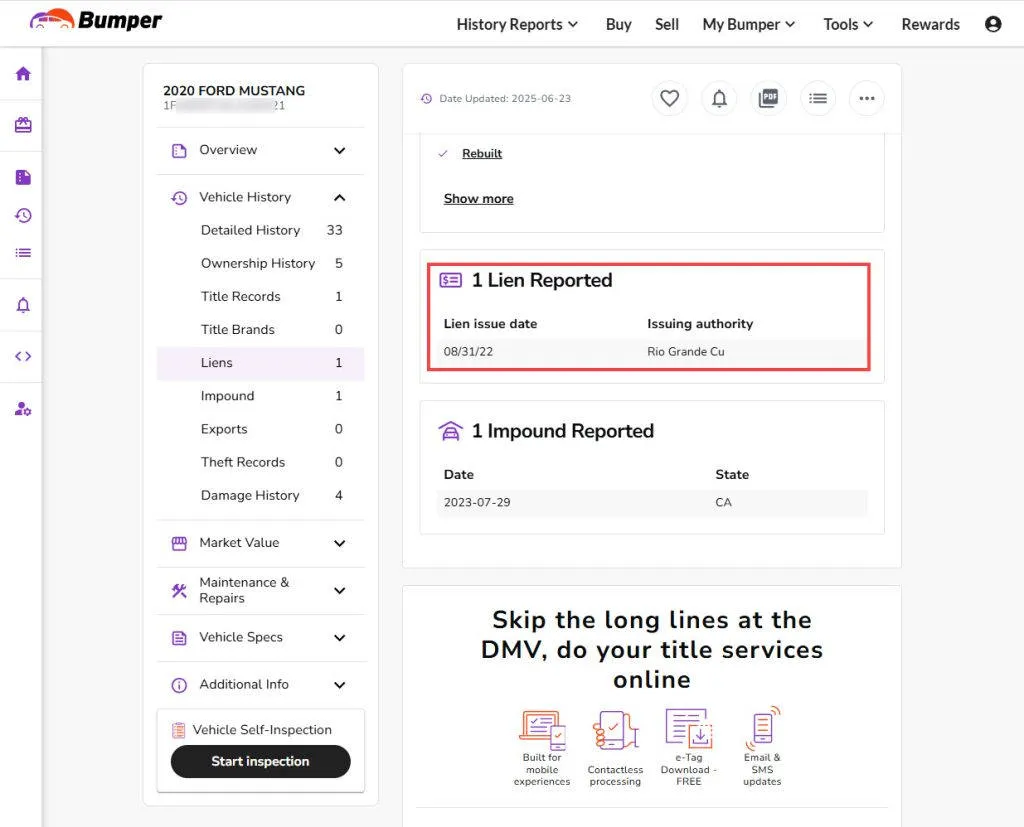

- Lienholder information available

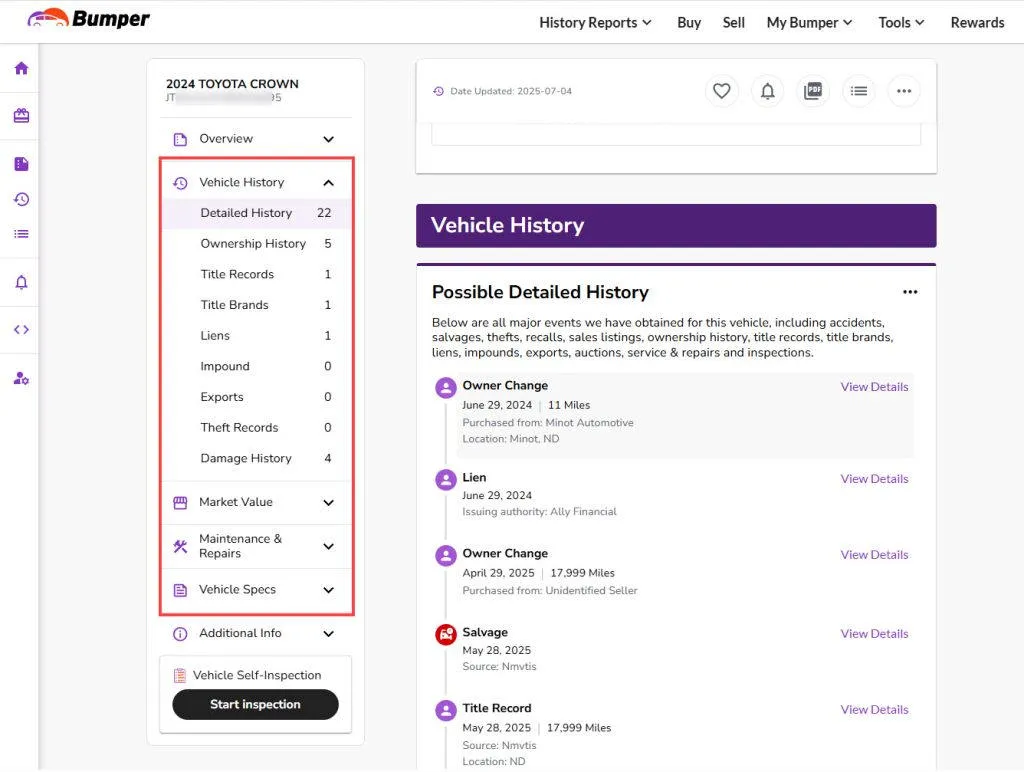

Bumper doesn’t just tell you if there’s a lien, it could tell you who the lienholder is (if available), which is valuable information you might not find even with other well-known services. This is thanks to Bumper’s close connection with the NMVTIS, state motor vehicle titling agencies, and financial institutions, giving you access to more data available.

- Extensive information

Beyond lien information, Bumper could give you a detailed story on a car’s history, drawing from a vast network of data sources like government records, insurance companies, repair shops, and some exclusive industry partners. This gives you a detailed picture of its past accidents3, number of previous owners, service & maintenance records, registration details, and much more.

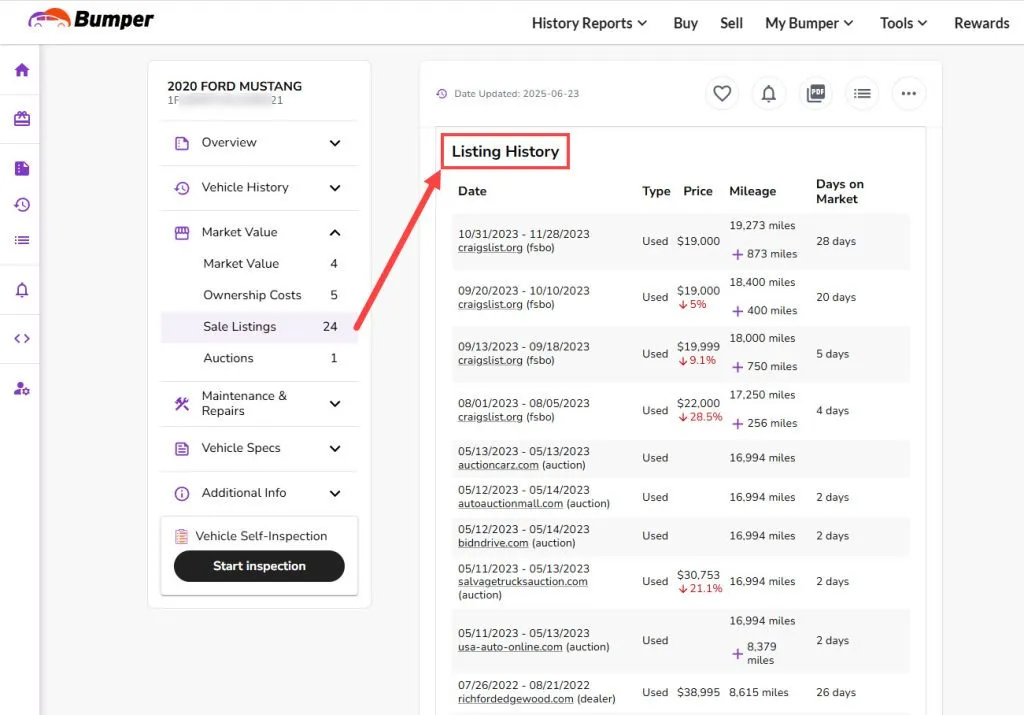

We’ve even found that Bumper could often provide detailed sales listings from past auctions and dealerships, showing you the listing price and how long the car was on the market – all in one place. This helps you understand the car’s market value and negotiate a fair price.

To make sure you understand everything in your vehicle history report, check out our handy guide: How to read a vehicle history report.

- Reasonable prices

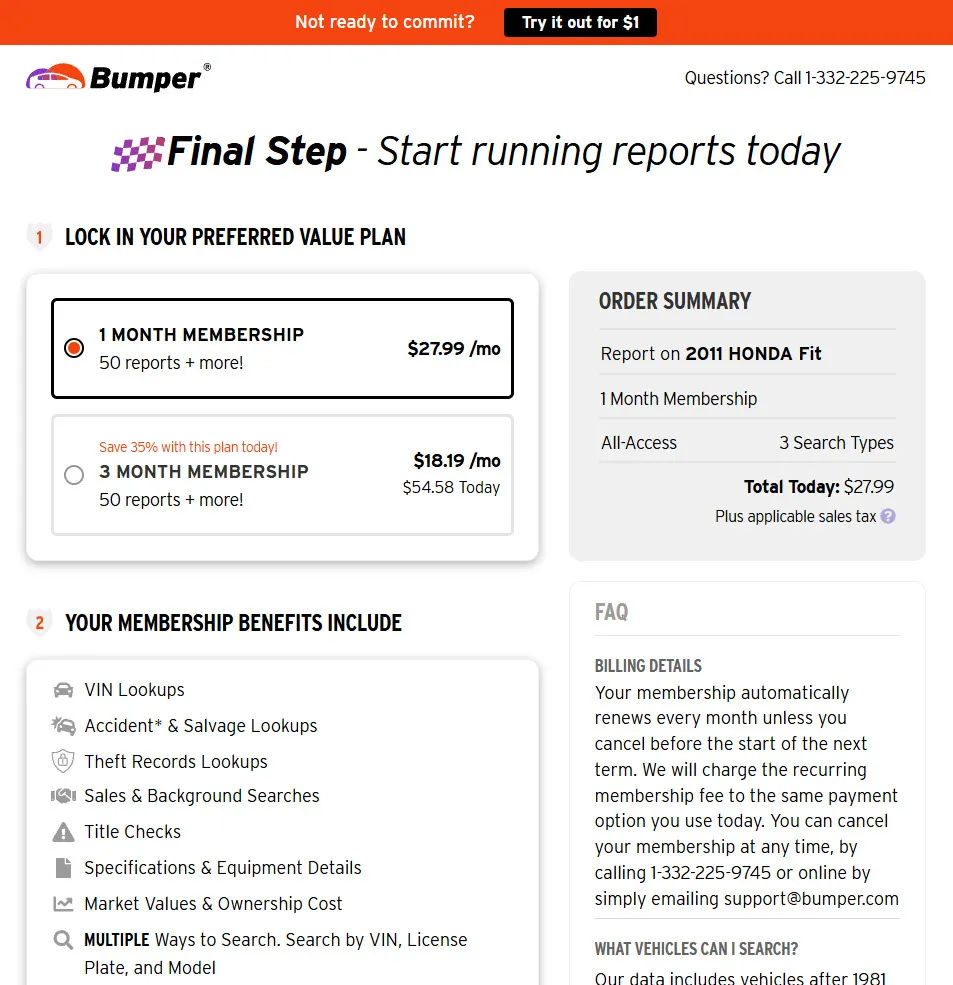

While many services charge high per-report fees, Bumper offers a simple, affordable subscription for just $27.99 per month, giving you 50 searches monthly – perfect for comparing multiple vehicles.

It also offers a cheap 7-day trial that can allow you to try it out without risk. And for extra peace of mind, it offers payment through Apple Pay, Google Pay, and PayPal, apart from credit cards.

Alternative: EpicVIN

If you’re shopping for a truck, EpicVIN might be another NMVTIS-approved provider worth checking out. Like Bumper, it works on a subscription basis, allowing for multiple searches. Some customers shared that EpicVIN seems to offer more detailed information on trucks than smaller vehicles.

EpicVIN includes photos from past sales and auctions, which can be valuable for spotting potential previous damage.

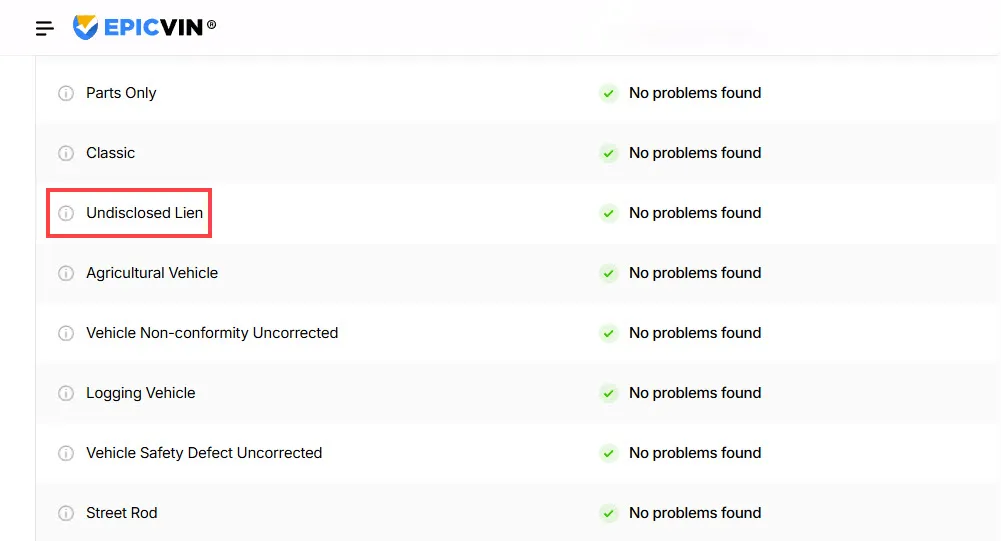

However, EpicVIN’s lien information isn’t as comprehensive as Bumper’s. It could tell you if there might be an undisclosed lien, but it might not provide details about the lienholder. So, if lien information is your top priority, Bumper might be the better choice.

Beware: Liens might not show up on vehicle history reports

While vehicle history reports are helpful, they’re not perfect. It’s entirely possible for a car to have a lien against it that doesn’t appear on the report. Here are a few reasons:

- Reporting delays: DMVs and other reporting agencies don’t always update vehicle history reports in real time. There can be delays or gaps in reporting, meaning a newly registered lien might not immediately show up.

- Different state requirements: Not all states have the same requirements for reporting liens, and some states may have less comprehensive reporting practices than others. This can lead to inconsistencies.

- Small lenders: Liens from smaller lenders or informal loans sometimes fly under the radar and don’t get reported to the major databases.

- Released liens: While reports should show that a lien has been released, sometimes the release isn’t recorded promptly or accurately, leading to confusion.

To be sure, you can take extra steps by checking with your local DMV, verifying directly with the lienholder, and carefully reviewing all the paperwork.

Method 3. Contact the DMV

Checking with the DMV can give you the most up-to-date and reliable information on a vehicle’s lien status. You’ll usually need to get the VIN and the title number (if the seller has it). It will help the DMV locate the vehicle’s record.

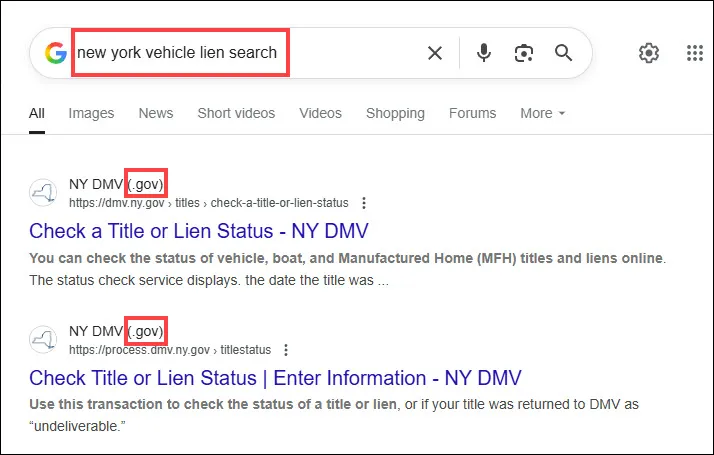

1. Find the right DMV

Each state handles titling a little differently, so you’ll need to contact the DMV where the vehicle is currently registered. A quick Google search for “[state name] vehicle lien check” should lead you to the right .gov website.

Look for pages with titles like “Title Check”, “Vehicle Title”, or “Vehicle Title and Registration”.

Note: Each state might have a slightly different name for its DMV (like Department of Motor Vehicles or Motor Vehicle Division), but simply searching for DMV will generally point you to the correct website.

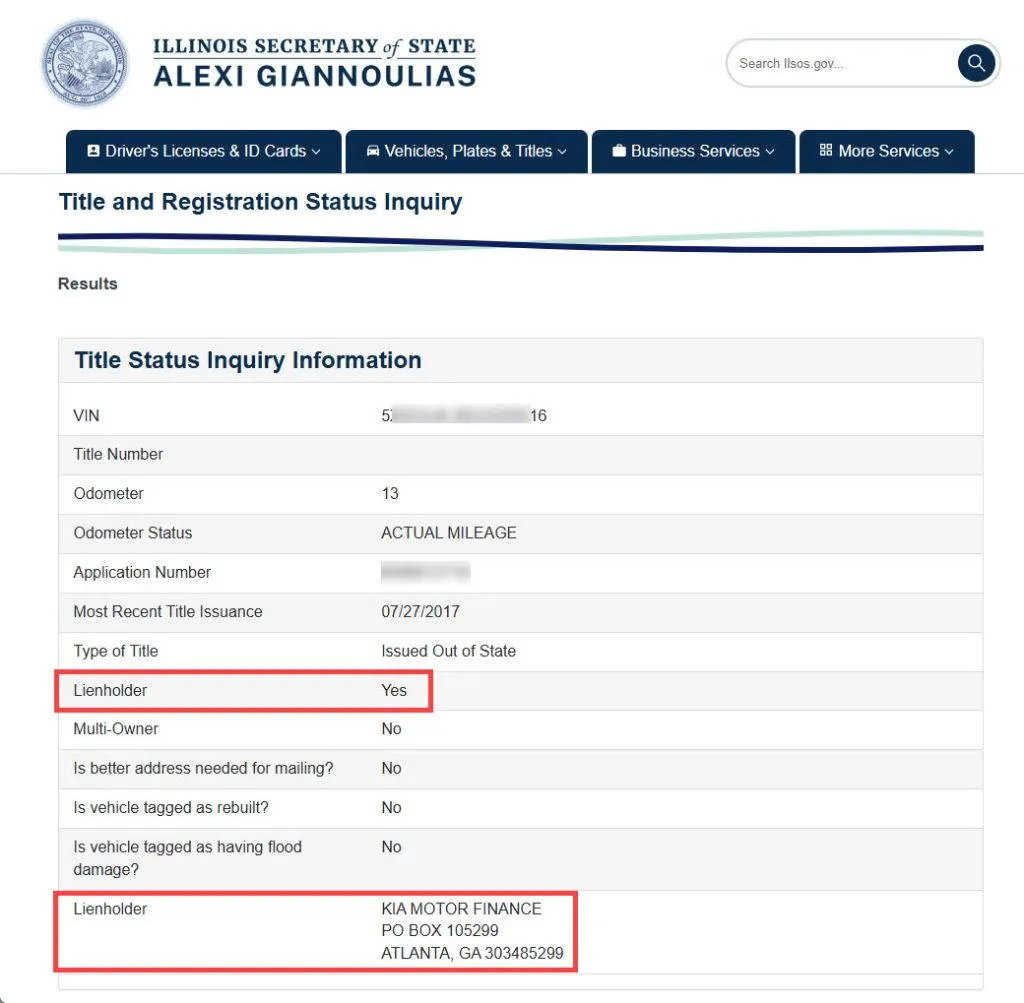

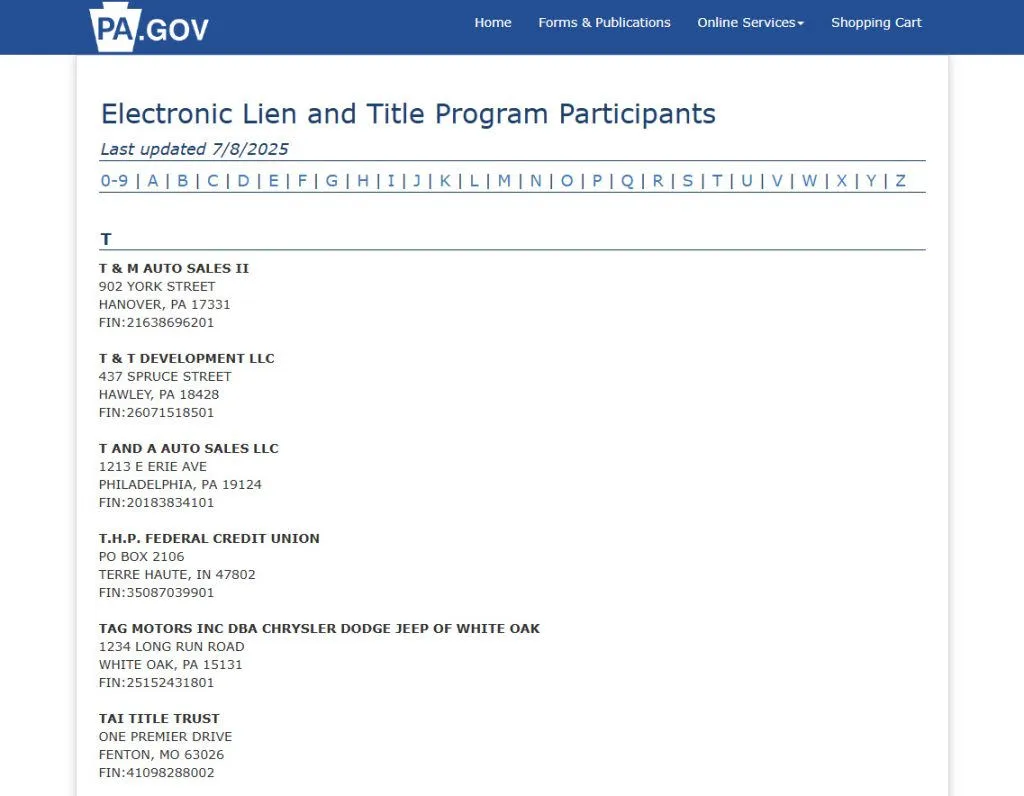

2. Check for online options

Some states (like New York, Illinois, Wisconsin, and Florida) offer dedicated lien check portals through their DMVs or Secretary of State pages. This is the quickest and easiest method.

3. Request title information (if necessary)

If your state doesn’t offer a dedicated lien check page, you might need to request the title information directly from the DMV. This usually requires the registered owner’s involvement, so it’s best to coordinate with the seller.

Many states now handle titles electronically, so you might be able to access this information online through the DMV website.

The bottom line is, don’t just take the seller’s word for it, even if they seem trustworthy. A quick check with the DMV gives you peace of mind and confirms you’re buying a car free and clear.

Method 4. Ask the lender directly (if available)

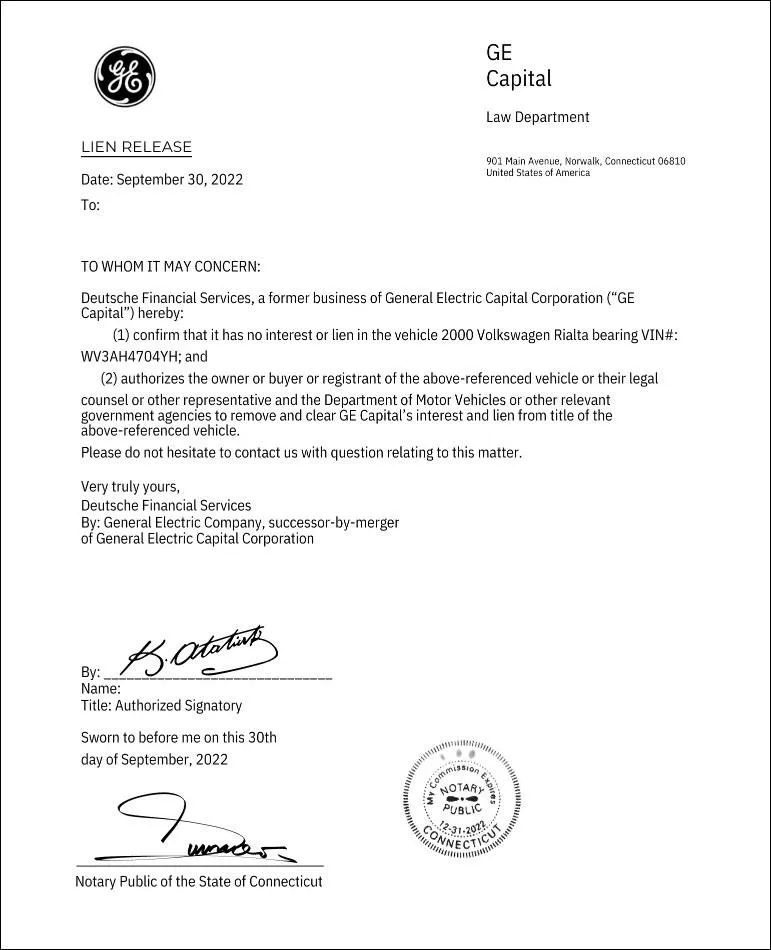

If you know who the lienholder is but have doubts about the seller’s honesty regarding the loan (for example, they claim it’s paid off but fail to provide the release), it’s wise to verify the information directly with the lender.

- Before you go any further, make sure you have the vehicle’s VIN.

- Then, reach out to the lender by phone or email and explain that you’re a potential buyer and want to confirm if the lien has been released. You can ask the seller to make the contact if you prefer, but it’s always best to hear it directly from the lender.

If the lien has been satisfied, they should also be able to provide you with a lien release document or a letter confirming so. Once you have that in hand, you’re good to move forward with the rest of the sale and title transfer process.

FAQs

Are liens always a dealer-breaker when buying a used car?

Not necessarily. Most cars are financed these days, so it’s very common for a used car to have had a lien at some point. As long as the lien has been released and the title is clear, there’s nothing to worry about.

However, if there’s a current lien, you’ll need to take extra precautions. Make absolutely sure the lien is paid off and the title is transferred into your name before you hand over any money for the car.

What’s the process for buying a car with a lien on it?

It depends on whether you’re buying from a private seller or a dealership4.

From a private seller

Buying from a private party with an existing lien is more complex and requires careful attention to detail.

– Verify lien release: Before paying for the car, obtain the lien release document from the seller or directly from the lender. This is crucial.

– Obtain clear title: The seller must obtain a clear title from the DMV after the lien is released. This usually involves submitting the lien release and other necessary paperwork.

– Transfer title: Once the seller has the clear title, they can transfer it to your name at the DMV. Be prepared for paperwork and potential DMV visits.

From a dealership

Buying from a dealership is typically much simpler. Dealers typically handle any existing liens before putting a car on the lot. However, it’s still a good idea to confirm this with the dealer and ensure they handle the title transfer promptly after the sale. While stories of dealerships failing to properly handle titles are rare, they do happen5, and can lead to significant legal headaches. Choosing a reputable dealership can minimize this risk.

What to do if the original title is lost?

When buying a used car and the seller informs you the original title is lost, several steps must be taken before you can legally get ownership. That can include:

– Seller applies for a duplicate title: The seller must apply for a duplicate title through their state’s DMV or equivalent agency. Some states offer this service online, while others require an in-person visit.

– Lienholder involvement: If there’s an active lien on the vehicle, getting a duplicate title usually means the lienholder needs to be involved. It differs from state to state, but they might need to sign off on the application or send in some extra paperwork.

– Verification of information: The DMV will verify the seller’s information and the vehicle’s details before issuing a duplicate title.

– Completing the sale and title transfer: After the seller receives the duplicate title, you can proceed with the sale and title transfer as you normally would.

Footnotes

- r/UsedCars [Mountain_Ad8844]. (2024, December 19). Bought a vehicle with a lien on it. Cashed the check at our bank. Had a bill of sale signed. Seller never paid off lien and has now picked up and left. What are my options? [Online forum post]. Reddit. https://www.reddit.com/r/UsedCars/comments/1hhlv1f/bought_a_vehicle_with_a_lien_on_it_cashed_the/[↩]

- Note that vehicle history reports cannot take the place of checking with DMVs.[↩]

- Bumper reports are based on data available and may not include historical accident records in all states.[↩]

- The process might vary slightly by state.[↩]

- r/Hyundai [Fack_Duck]. (2023, June 16). NYS – Dealership sold me a used car with a lien on it, they claim there is no lien, DMV says they’re lying and there is a lien on the title. They are refusing to take car back, or give me any updates, and are refusing to show me the title. [Online forum post]. Reddit. https://www.reddit.com/r/Hyundai/comments/14a7j55/nys_dealership_sold_me_a_used_car_with_a_lien_on/[↩]

View all of Arlee Hu's posts.

View all of Arlee Hu's posts.