7 Common Types of Identity Theft You Need to Know

Identity theft is when someone uses your personal information (such as your name, address, social security number, credit card number, etc.) to commit fraud. They may use your information to open accounts, file taxes, make purchases or get medical services. These acts can ruin your credit and cause financial losses. Understanding different types of identity theft can help you better protect yourself.

What are the different types of identity theft?

There are several common types of identity theft you need to know:

1. Financial Identity Theft

Financial identity theft occurs when someone uses your personal information for financial benefits. Thieves may use your bank accounts or credit card numbers to make purchases, or they may use your Social Security number to take out loans or get new credit cards in your name. This kind of identity theft can seriously hurt your credit.

Warning signs: Unfamiliar transaction on your credit card or bank statement; Accounts you don’t recognize on your credit report.

2. Medical Identity Theft

Medical identity theft is when someone uses your personal information to get medical care, health insurance coverage or prescriptions. Thieves might steal your name, Social Security number, health insurance account number or Medicare number. When medical identity theft occurs, it can not only lead to financial losses but also denial of medical services or improper treatment.

Warning signs: Strange medical bills for services you didn’t get; Notification from your health insurance company saying your benefits are used up.

3. Child Identity Theft

Child identity theft is when someone uses a child’s personal information to get services or benefits, or to commit fraud. Thieves might steal your child’s name, date of birth, or Social Security number to open bank or credit card accounts, rent a place to live, or apply for government benefits, like health care coverage or nutrition assistance. Family members, close friends, and relatives are most likely to commit child identity.

Warning signs: Your child is denied a student loan or government benefits; Your child already has a credit report.

4. Tax Identity Theft

Tax identity theft happens when someone uses your Social Security number to falsely file tax returns or for work. People often discover tax identity theft when they file their tax returns with the IRS.

Warning signs: The IRS notifies you that more than one tax return was filed using your name or Social Security number; IRS records indicate you were paid by an employer you didn’t work for.

5. Unemployment Identity Theft

Unemployment identity theft occurs when someone uses your personal information to claim unemployment benefits.

Warning signs: You receive a 1099-G tax form reflecting unemployment benefits you weren’t expecting; You receive mail from a government agency about an unemployment claim or payment you didn’t request.

6. Criminal Identity Theft

Criminal identity theft is when a criminal gives law enforcement your personal information instead of their own. Victims may never know until they are stopped for a driving violation and realize there is an arrest warrant in their name.

Warning signs: You get an unexpected warrant out for your arrest; You receive an unpaid speeding ticket.

7. Synthetic Identity Theft

Synthetic identity theft is when someone uses a combination of real and fake personal information to create a new identity. For example, thieves may use your Social Security number and combine it with a different name, address and phone number to open new bank accounts. This is the fastest growing type of ID fraud and is difficult to detect.

Warning signs: You find discrepancies and unfamiliar accounts on your credit report; You receive calls from debt collectors about debts that are not yours.

How to protect yourself against identity theft?

Here are some tips you can take to help you avoid identity theft:

- Store documents with personal information in a safe place. These documents include your Social Security card, Medicare card, tax records, financial and medical records, etc.

- Shred any documents with personal information before you throw them away. If you don’t have a shredder, look for a local shred day.

- Only give out your Social Security number when necessary. If someone asks for your Social Security number, ask these questions:

Why do you need it?

How will you protect it?

Can you use a different identifier?

Can you use just the last four digits of the Social Security number?

- Use strong passwords and multi-factor authentication for your online accounts. Don’t reuse your password.

- Use a VPN if you use public Wi-Fi.

- Install firewalls and antivirus software on your home computer. Make sure the security software is up to date.

- Don’t give your personal information over the phone or through email. It could be a phishing scam.

- Check your credit card and bank statements carefully and often.

- Know your payment due dates. If a bill doesn’t show up when you expect it, look into it.

- Read the statements from your health insurance plan. Make sure the claims paid match the care you got.

- Review your credit report at least once a year. You can order it for free from Annualcreditreport.com.

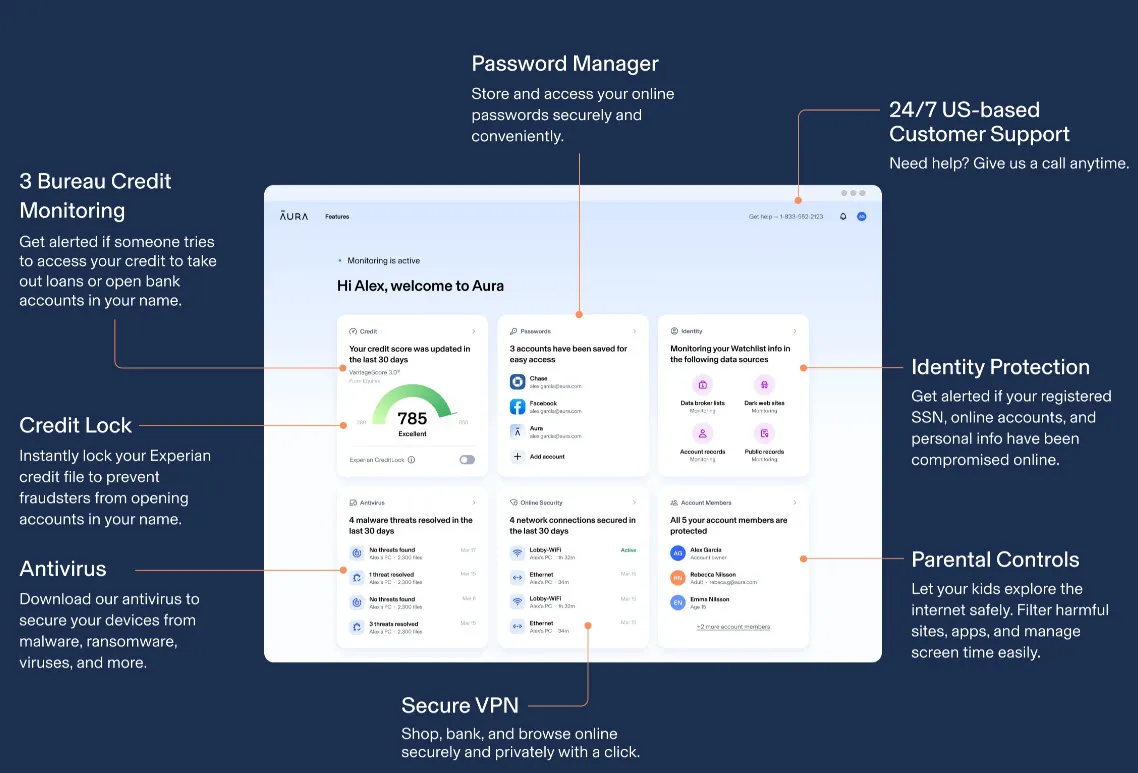

- Consider using an identity theft protection service, like Aura.

Aura is a leading provider of digital security products for consumers. It helps keep you and your family safe from identity theft, financial fraud, and online threats. With Aura, you’ll get credit monitoring with fraud alerts, identity theft and online account protection, password manager, antivirus, VPN, a $1,000,000 theft insurance and more.

Credit: Featured Image by Sam Williams from Pixabay

View all of Lily Qiu's posts.

View all of Lily Qiu's posts.

![[SOLVED] How to protect your online identity [SOLVED] How to protect your online identity](https://www.supereasy.com/wp-content/uploads/2022/11/online-identity-protection.jpeg)