Social Security Number Found On Dark Web? Here’s What To Do

Is Your SSN At Risk?

Enter Email Address. Check If Your SSN is Leaked to the Dark Web.

Your nine-digit social security number (SSN) holds a great deal of significance to your financial life. Basically, it’s how you open your bank account, collect government benefits, apply for a new job, and use it for other purposes as part of your identity. Unfortunately, for the very same reason, it is also a highly sought-after target for criminals.

If you’ve found your SSN on the dark web1, don’t freak out. The silver lining is – with nearly every American having their SSN compromised at least once in their life*, it’d be like hitting the jackpot for a criminal to specifically target yours out of the massive database. Yet still, there are 6 steps you should take to secure yourself against further breach and minimize the resulting damage.

Best Identity Protection Services

- Constant dark web monitoring

- All-in-one identity credit and device protection

- Credit lock

- 14-day free trial

- Credit Monitoring & Bank Account Protection

- 24/7 fraud remediation agents and support

- $1M Insurance

- #1 rated ID theft protection

- Comprehensive monitoring

- Nationwide $1 million identity theft insurance policy

- SSN Fraud & Credit Alerts

- Dark Web Monitoring

- Identity Restoration

- 1 Million Privacy Insurance

- Continued dark web & credit monitoring

- Fraud Restoration with LPOA

- $1 million Identity Theft Insurance

What does it mean when your SSN is found on the dark web?

An identity thief can steal your SSN in a variety of ways. Some rummage through the trash for personal documents and others gain unauthorized entry to your critical data by hacking into your accounts, planting malware in your system, and harvesting through data breaches. Most leaked SSNs will ultimately land on the dark web, where they are sold for as little as $4, according to research by Atlas.

The dark web is an unregulated part of the internet where everything is intended to be anonymous and untraceable. Given its heavy encryption nature, it has a sinister reputation for being the hub of black market activities, such as the illegal selling of personal, financial, and credit information. If your information, such as your SSN is found on the dark web, unfortunately, there’s virtually no way to get it removed.

Finding your SSN on the dark web may not necessarily mean that your identity has already been abused at the miscreants’ free will but it is a warning sign that your personal information is compromised. With your SSN and a little bit of other information, an identity thief may impersonate you and exploit your identity in a wide range of ways such as:

- Opening a new bank account or credit card account

- Draining your bank account

- Getting a driver’s license

- Filing a fraudulent tax return

- Applying for a job

- Committing other fraud or crime of choice

which could damage nearly every aspect of your life, including your personal reputation and emotional well-being.

In this case, you should take active measures to mitigate potential damage.

What to do if your SSN or identity is stolen

1. Use an identity protection service

Identity theft is an ever-present threat. To protect yourself against it, there are some good cyber hygiene habits to get into: safeguard your SSN card, limit what you share online, be extra careful of the sites you visit, the emails you open, the files you download – the list could go on and on. But even the most cautious internet surfer is not immune from cyber-attacks.

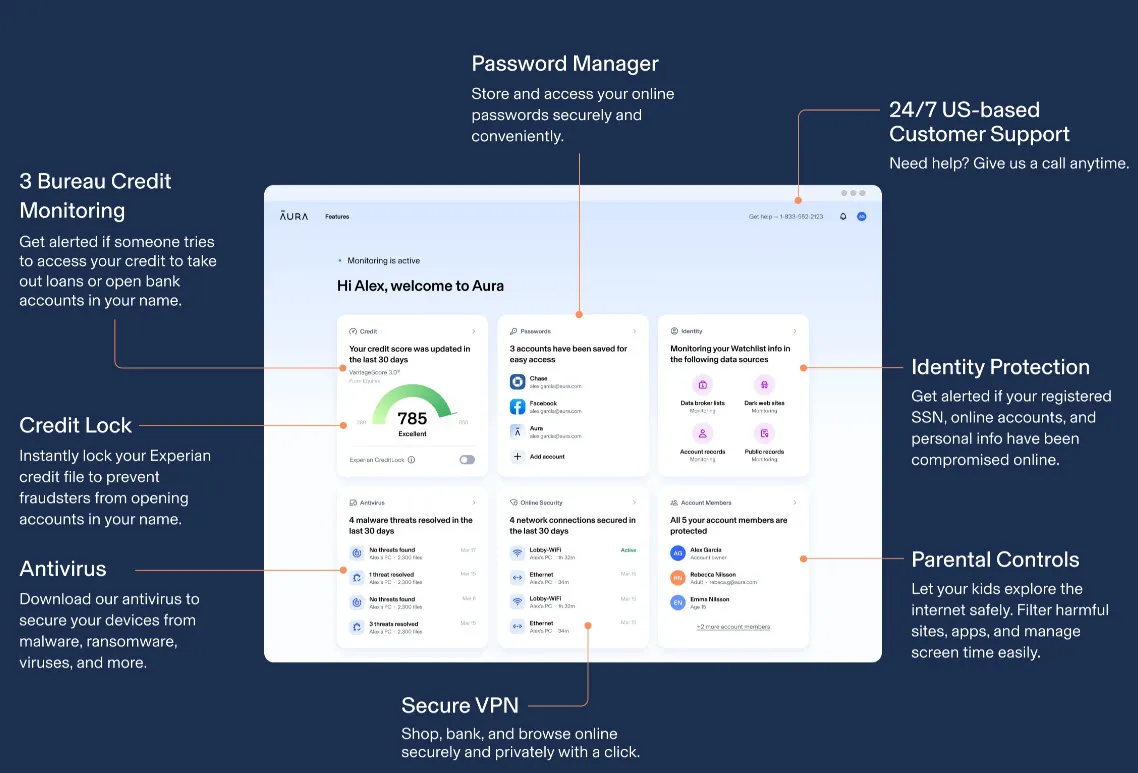

If you don’t want to go with the DIY approach, perhaps you can consider Aura, an all-in-one identity protection service to give you 24/7 proactive protection against identity theft and fraud.

With Aura, you get:

- Dark web scan and monitoring: It isn’t just your SSN, but other types of PII such as your banking details, email passwords, online accounts, and address are also valuable targets to criminals. You can run a one-time dark web scan or start Aura’s real-time monitoring to check if your personal information is at risk.

- Credit monitoring – Aura continuously monitors your credit reports from the three major credit agencies – TransUnion, Equifax, and Experian, and alerts you if any unusual activity is detected.

- Password Manager – Weak, easily-guessable passwords may leave your accounts wide open to attack. Aura’s password manager helps you generate long, unique, and complex passwords without you having to remember them by yourself.

- Antivirus – The antivirus software gives you 24/7 protection from malware, ransomware, keyloggers, and more.

- VPN – The military-grade VPN gives you high levels of anonymity and privacy to browse, shop, and bank online.

- Family identity protection – The family plan provides identity protection for up to five family members.

- A $1,000,000 insurance policy – Aura’s insurance policy covers up to $1 million for eligible losses from identity theft.

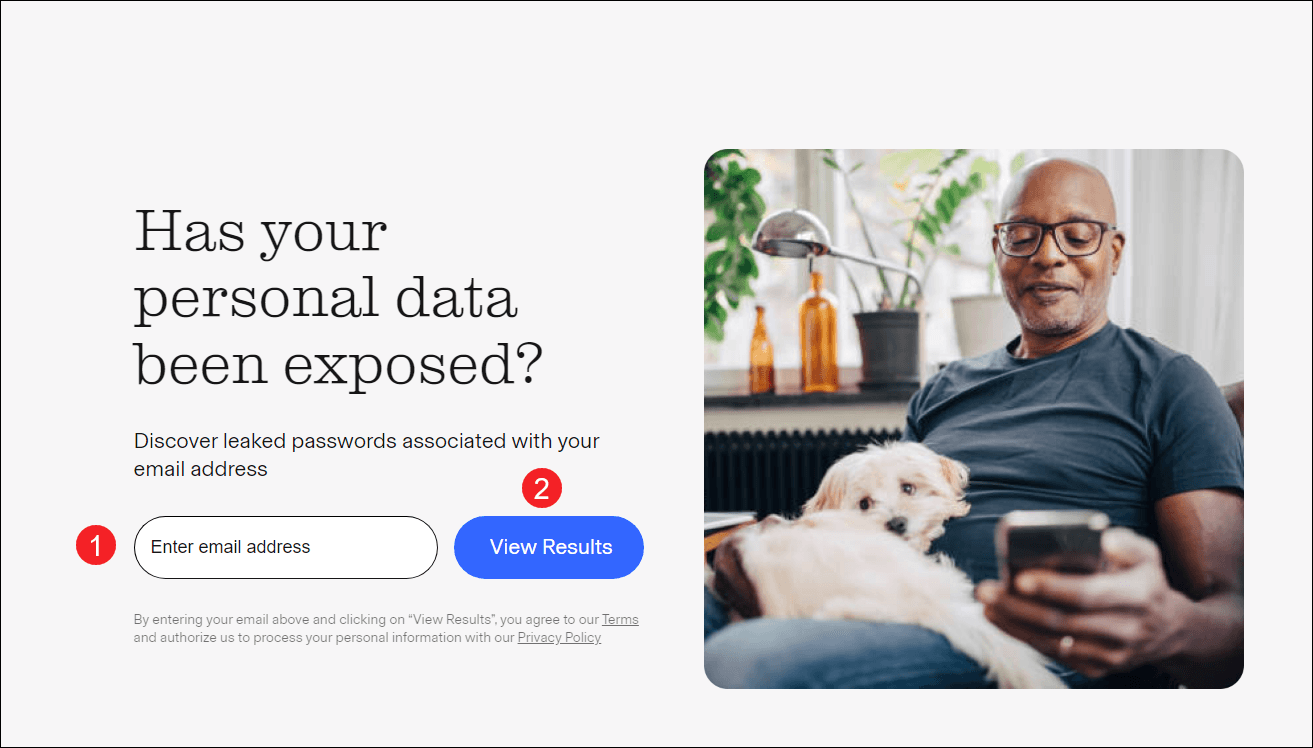

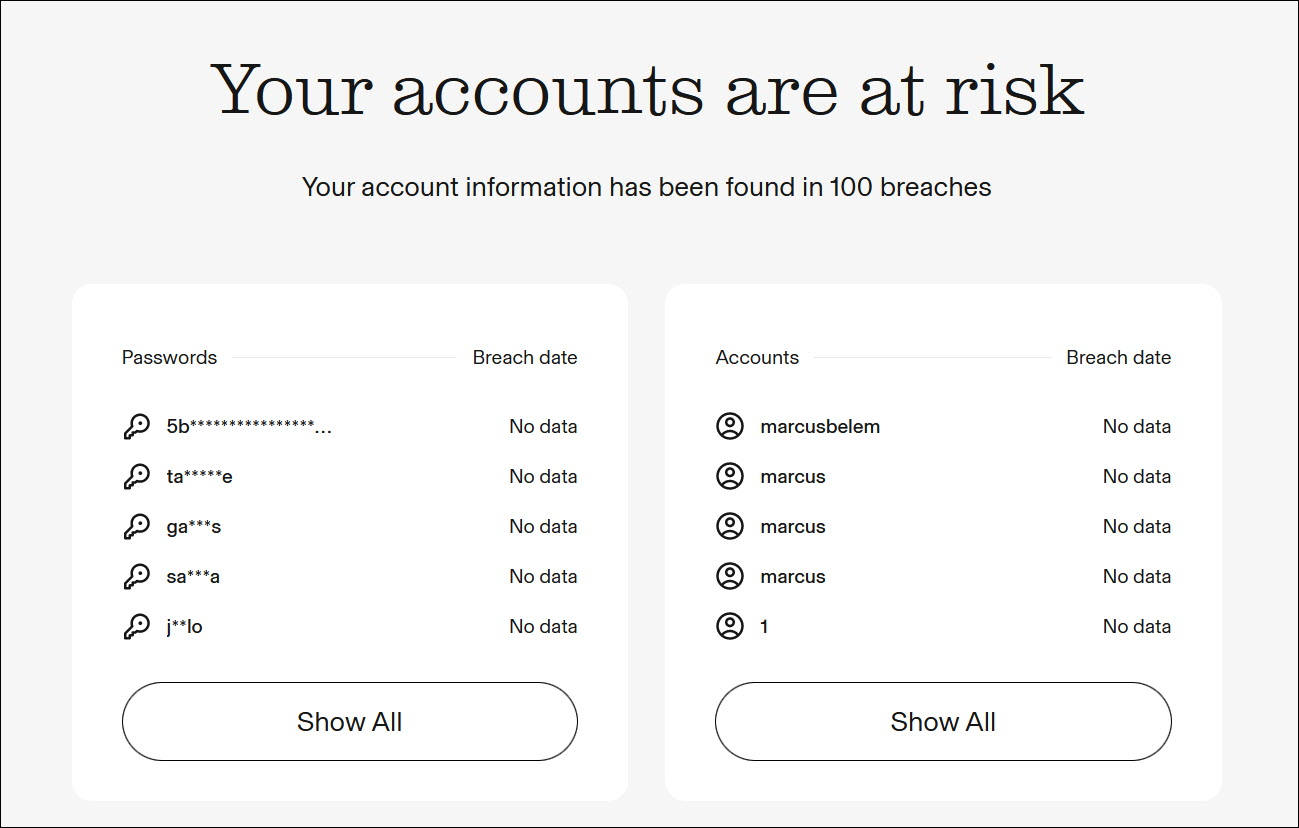

Here is how to use Aura to run an in-depth dark web scan to see if your personal information has made its way to the dark web or other places where it shouldn’t be:

- Go to the Aura Free Scan page.

- Enter your email address and click View Results.

- Wait a few seconds as Aura scans the dark corners of the web to search for possible exposure of your personal data.

- You can start the 14-day free trial to access the full report, along with its full array of identity protection tools.

2. Place a credit freeze or fraud alert

A credit freeze, also known as a security freeze, restricts access to your credit report. It prevents anyone from accessing the credit report – not even you or anyone with the credentials. Any new requests for a loan or a new account in your name will be automatically declined, which effectively helps ward off prospective scammers from tarnishing your credit.

To freeze your credit report, you’ll need to contact each of the three major credit-reporting bureaus separately:

- Equifax: Call 1-800-349-9960 or place a security freeze online

- Experian: Call 1-888‑397‑3742 or freeze your credit file online

- TransUnion: Call 1-888-909-8872 or use a credit freeze online

One thing to note though: there will be some subsequent inconveniences. With the freeze in place, you won’t be able to apply for a new credit card or take out a loan yourself, unless you temporarily lift or remove the freeze.

A credit freeze lasts until you decide to remove it. Placing, temporarily lifting, or permanently removing a credit freeze is free, and none will have an effect on your credit score.

3. Place a fraud alert

If you believe your SSN turns up for sale on the dark web but don’t have any proof of it being fraudulently used, consider placing a fraud alert. A fraud alert will encourage lenders and creditors to contact you to verify before extending any credit. It will not block access to your credit report but it still provides an added layer of protection against identity fraud.

Fraud alerts are free and easy to set up. All you need to do is to contact one of the three nationwide bureaus – Equifax, Experian, and TransUnion – then the alert will apply to the other two.

- Equifax: Call 1-888-766-0008 or place Fraud or Active Duty Alerts online

- Experian: Call 1-888-397-3742 or add a fraud alert online

- TransUnion: Call 1-800-680-7289 or add a fraud alert online

A fraud alert lasts for one year and can be removed at any time. Neither action will affect your credit score.

4. Monitor your credit report & statements

Your credit report is a detailed account of your credit activity. It contains important information, such as active & closed credit accounts, payment history, credit inquiries, and the amount owned, which may lend itself to reflecting early signs of identity theft. The same applies to your financial and medical statements.

It’s important that you stay on top of your credit reports and statements – make sure you recognize every action you make and be vigilant. Any notice of new accounts you didn’t open, transactions you don’t recognize, bills for medical treatment you never received, and overdue bills may clue you in on potential SSN-related fraud.

5. Create a my Social Security account

my Social Security is the Social Security Administration’s (SSA) online portal. It provides you with easy access to a wide range of services and allows you to keep track of your estimated social security benefits. Since a my Social Security account is uniquely linked to a Social Security Number, you should create it yourself before identity thieves could get their hands on it and steal your benefits. To do so, simply head over to SSA My Account page, and follow the on-screen instructions to set up your account.

6. Report the identity theft to authorities

As discussed, there are various ways an identity thief can do with your SSN, mostly to the detriment of your personal reputation and financial well-being. To prevent the ID thief from creating further problems, one last step you should take is to report your case to the authorities.

Here is how:

- Report identity theft to IdentityTheft.gov: Run by the Federal Trade Commission, IdentityTheft.gov is a federal-level one-stop resource for identity theft victims. To report your case, you can visit IdentityTheft.gov or call 1-877-438-4338 (meaning 1-877-IDTHEFT in T9 texting) or 1-866-653-4261. The FTC will then collect information about your situation and walk you through the recovery process.

- Contact the Internal Revenue Service (IRS): SSN theft may also be associated with tax identity theft where an identity thief files a fraudulent return to claim your refund. To combat tax-related identity theft, you should contact IRS by visiting IRS Identity Protection or calling 1-800-908-4490.

- File a police report: Last but not least, report the crime to your local jurisdiction. Provide as much information as you possibly can and it may help expedite your identity recovery.

- Personal Finance (Not Investing) [naturetech]. (2022, September 13) SSN on a Dark Web [Online forum post]. BogleHeads.

https://www.bogleheads.org/forum/viewtopic.php?t=385889 ↩︎

Credit: Image by rawpixel.com on Freepik

View all of Enya Zhang's posts.

View all of Enya Zhang's posts.