Renters Insurance – Best Cheap Starting from $5/mo. (not a typo)

Lemonade™ – Renters Insurance from $5/mo

Get covered with America’s #1 insurance – no brokers, no paperwork, Join Now! Simple and transparent. Monthly subscription. Services: 24/7 claim service, seconds to get insured.

In today’s world, protecting your belongings and ensuring your financial security is of utmost importance. Renters insurance offers an affordable solution to safeguard your possessions and provide liability coverage in case of unexpected events.

In this comprehensive guide, we will explore the necessity of renters insurance, coverage details, factors affecting cost, tips to save on premiums, and a list of the cheapest renters insurance companies. Discover how you can secure peace of mind without breaking the bank!

As you dive in, you’ll get answers to…

Is renters insurance required and worth it

Before going into details about renters insurance, we would like to let you know that renters insurance is not legally required. However, in some cases, landlords may require tenants to have renters insurance as a condition of the lease agreement. It is essential to review your lease agreement to determine if renters insurance is mandatory.

Even if it is not mandatory, it is still highly recommended to have renters insurance. Below are several reasons why it is necessary to buy renters insurance:

1. Protection for personal belongings

Renters insurance covers your personal belongings from various risks, including theft, fire, vandalism, and natural disasters. It ensures that you can replace or repair your items in case of damage or loss.

2. Liability coverage

Renters insurance includes liability coverage, which protects you financially if someone gets injured in your rental property and holds you responsible for their medical expenses or property damage. It helps safeguard your savings and assets in the event of a lawsuit.

3. Loss of use coverage

In the unfortunate event that your rental becomes uninhabitable due to a covered incident, such as a fire or severe storm, renters insurance can help cover additional living expenses. This includes costs for temporary accommodations, meals, and other necessary expenses.

4. Peace of mind

Renters insurance provides peace of mind by offering financial security and protection against unforeseen circumstances. Knowing that you are covered in case of accidents, theft, or natural disasters allows you to focus on enjoying your rented space without constant worry.

5. Affordable coverage

Get a Renters Insurance Quote Online & Buy Today | State Farm

Be sure you are protected against the unexpected with renters insurance. Its cost is less than that of a few cups of coffee a week.

Renters insurance is known for being affordable. Based on the National Association of Insurance Commissioners (NAIC) survey, renters insurance runs about $15 a month for approximately $35,000 in coverage limits. And some companies are offering even more affordable renters insurance, starting as low as $5 per month! Considering the extensive coverage it provides, the cost is minimal compared to the potential financial loss you could face without insurance.

How much renters insurance do I need

After you’ve learned what renters insurance covers as well as why it is necessary to buy renters insurance, you may wonder how to determine how much renters insurance you need. To accurately assess your insurance needs and select the right coverage, you can follow the steps below.

1. Create an inventory

Begin by taking inventory of all your personal belongings, including furniture, electronics, appliances, clothing, and valuable items. Note their estimated value and keep records, such as receipts, photographs, or appraisals, to support your assessment.

2. Estimate the value of your belongings

Assign a value to each item in your inventory. You can use online resources, price guides, or consult professionals to determine accurate values. Total the estimated value to get an overall picture of the worth of your possessions.

3. Consider replacement cost vs. actual cash value

Decide whether you want replacement cost (RCV) or actual cash value (ACV) coverage. Replacement cost coverage will reimburse you for the full cost of replacing an item, while actual cash value coverage considers depreciation. Keep in mind that replacement cost coverage may have a higher premium but offers more comprehensive protection.

How to Calculate Actual Cash Value

| Cost of MacBook Pro today (Replacement Cost) | |

| – | – |

| $0 | 45%…3 Years x 15% Per Year (Depreciation) |

| = | = |

| $0 | Actual Cash Value |

4. Evaluate liability coverage

Assess your liability coverage needs. Consider potential risks and the value of your assets. Higher liability limits are advisable if you have substantial assets or face increased liability risks, such as hosting frequent gatherings or owning a pet.

5. Factor in additional living Expenses

Review the coverage provided for additional living expenses. Calculate the potential costs of temporary accommodations, meals, and other essentials if your rental becomes uninhabitable due to a covered event. Ensure your coverage is sufficient to support your needs during such situations.

6. Consult with insurance professionals

Seek advice from insurance professionals who can provide personalized guidance based on your specific circumstances. They can help you understand policy options, coverage limits, and any additional endorsements that may be beneficial for your situation.

And the fact is you don’t need to pay extra for it. Most insurance companies are happy to assign a licensed representative who can guide you through the process.

Affordable Renters Coverage – Progressive® Insurance

Get a quote & protect your home with renters insurance for as low as $1/day in most states. Protect your personal possessions with an affordable renters policy. Quote Now!

or

Call a rep: 1-866-749-7436

How to save on renters insurance and get the best & cheapest

As stated in the previous section, renters insurance is significantly cheaper. Because it doesn’t cover the cost of rebuilding the entire structure. Then how much is it? Are there any discounts or ways to save more? And how to get the best and best renters insurance? No worries, we’ve got you covered in this section. See below for details.

How much is renters insurance

The renters insurance rate may change frequently. And it depends on several factors. Below are some of the common ones.

1. Location

The location of your rental property plays a significant role in determining the cost of renters insurance. Areas prone to natural disasters, such as hurricanes, earthquakes, or floods, may have higher premiums due to the increased risk of property damage. Similarly, neighborhoods with higher crime rates may also result in higher insurance costs to account for the potential risk of theft or vandalism.

2. Coverage limits

The coverage limits you choose for your renters insurance policy can affect the cost. Coverage limits refer to the maximum amount your insurance provider will pay for a covered loss. Opting for higher coverage limits provides greater protection but may result in higher premiums.

On the other hand, selecting lower coverage limits can help reduce costs, but it’s essential to ensure that you have adequate coverage for your belongings and liability.

3. Deductibles

A deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. Higher deductibles typically lead to lower monthly premiums since you are assuming more of the risk. However, it’s crucial to choose a deductible that you can comfortably afford to pay if a claim arises.

4. Optional add-ons

Renters insurance policies often offer optional add-ons or endorsements to enhance your coverage. These may include additional protection for valuable items like jewelry, electronics, or collectibles, as well as identity theft protection. While these add-ons provide valuable coverage, they can increase the overall cost of your policy.

How to save on renters insurance and get the best and cheapest

After you understand why the cost of renters insurance varies, it’s time to get your customized coverage. And being inspired by the factors that affect the renters insurance rate, you’ll want to employ some strategies to secure affordable coverage without compromising on the protection you need. Here’s a list of actionable tips that can help you cut costs on your renters insurance policy.

1. Shop around

Take the time to compare quotes from different insurance providers. This allows you to find the best coverage at the most competitive price.

Here are some companies that offer renters insurance at an affordable price. And it’s worth noting that the quotes below are only for reference and you’ll get the one that is tailored to your situation.

Lemonade Renters Insurance

When you shop around, you probably would find that Lemonade could be one of the cheapest ones. Being the most loved renters insurance in America, Lemonade can activate your policy and protect your stuff instantly thanks to its AI-powered tools.

However, Lemonade renters insurance is only available in 28 states plus Washington, D.C. If you reside out of these places, you may opt for another insurance company.

State Farm

As a widely recognized insurance option and one of the largest insurance providers in the United States, State Farm has renters insurance that is affordable for you. With competitive pricing starting at around $15 per month, comprehensive coverage, and a focus on customer service, State Farm renters insurance provides you with reliable protection and peace of mind.

Allstate

Available in all 50 states and Washington, D.C., Allstate is reliable and affordable. The renters policy has an average monthly premium of about $16. When you bundle it and auto insurance, you may be able to pay as little as $4 a month!

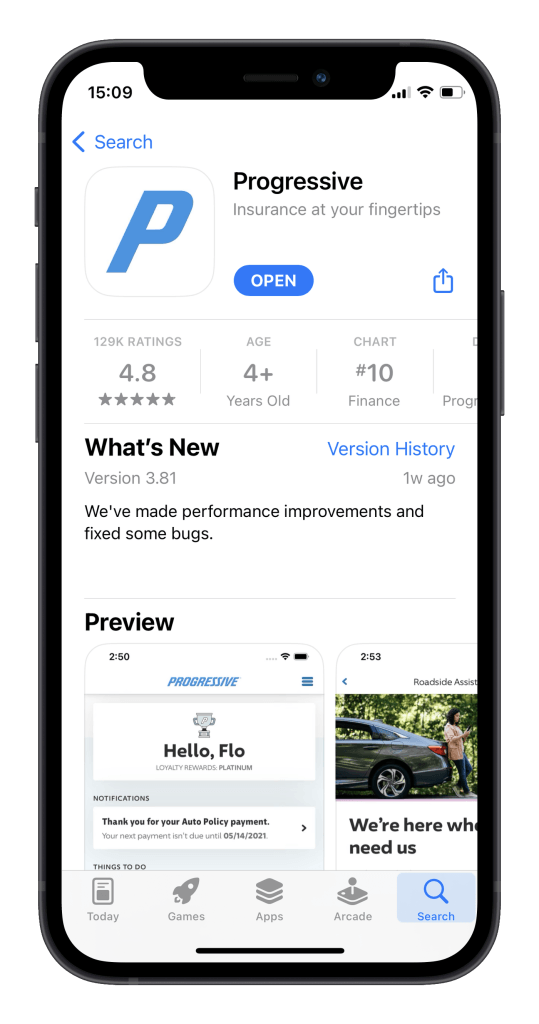

Progressive

Progressive could be expensive. But we include it in our list because it excels in the insurance industry. In addition, you still may be able to score a nice saving when buying renters insurance on Progressive. And it offers coverage in all states, as well as the District of Columbia.

2. Bundle policies

Consider bundling your renters insurance with other insurance policies, such as auto insurance. Many insurance companies offer discounts for multiple policies.

3. Increase your deductible

Opting for a higher deductible can lower your monthly premium. However, be sure to choose a deductible that you can comfortably afford to pay out of pocket in the event of a claim.

4. Install safety features

Installing smoke detectors, fire extinguishers, and security systems can make your rental property safer, potentially leading to discounts on your insurance premium.

5. Maintain good credit

Many insurance companies consider credit history when determining rates. Maintaining a good credit score can help you secure lower premiums.

6. Ask about discounts

Inquire with your insurance provider about any available discounts. Some insurers offer price breaks for non-smokers, seniors, or members of certain professional organizations.

So this is the comprehensive guide on everything you may want to know about purchasing renters insurance. Hope you can finally get the renters insurance that fits your budget! If you have any suggestions or ideas, do not hesitate to write them down in the comment section below. We’ll get back to you ASAP.

View all of Sammi Liu's posts.

View all of Sammi Liu's posts.