How To Protect Your Social Security Number From Identity Theft (2024)

Aura 14-Day Free Trial

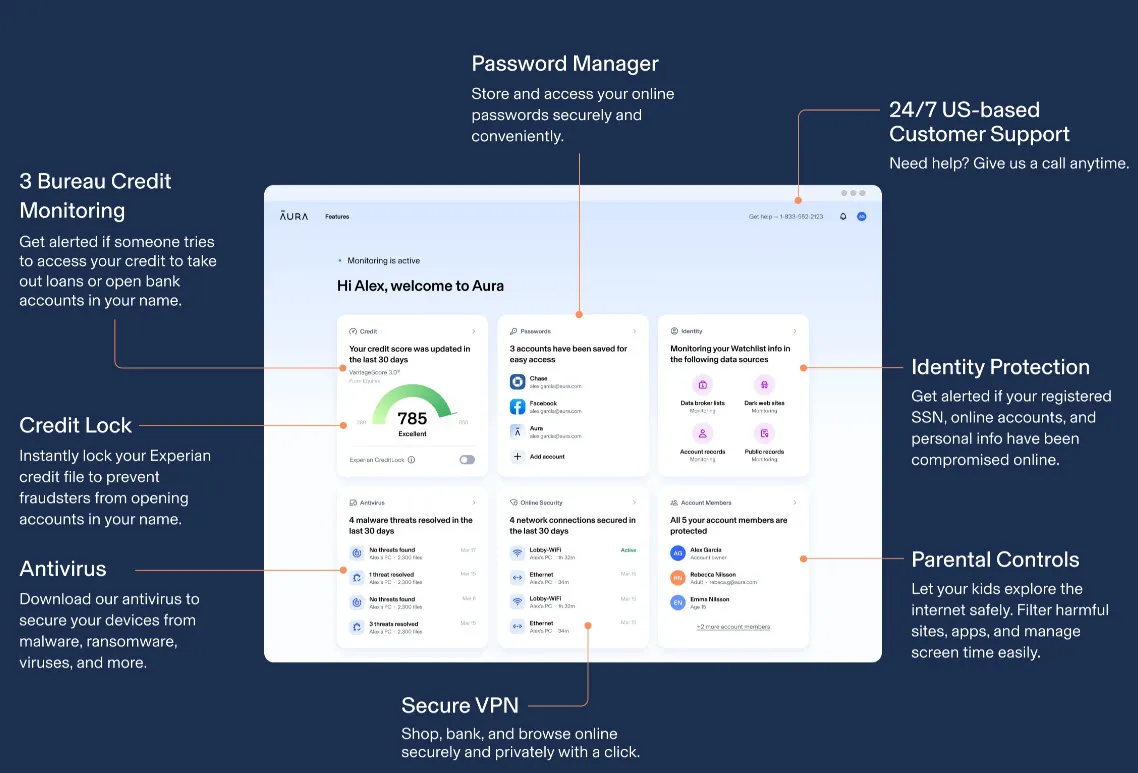

All-in-one, easy-to-use identity protection for you and your loved ones.

- 3 Bureau credit monitoring

- Identity Protection

- Password Manager

- Antivirus

- VPN

- Credit lock

- Family identity protection

- Dark web monitoring

Social Security Number theft is a fast-growing crime that has happened to many over the years. It typically occurs when someone steals your social security number and uses it without your permission. This may include using your medical benefits, starting a new job, opening bank accounts, applying for credits, and in some cases, committing a crime in your name – there’s practically no limit.

Disturbing as it is, there are some precautions you can take to protect your Social Security Number from identity theft. Read on…

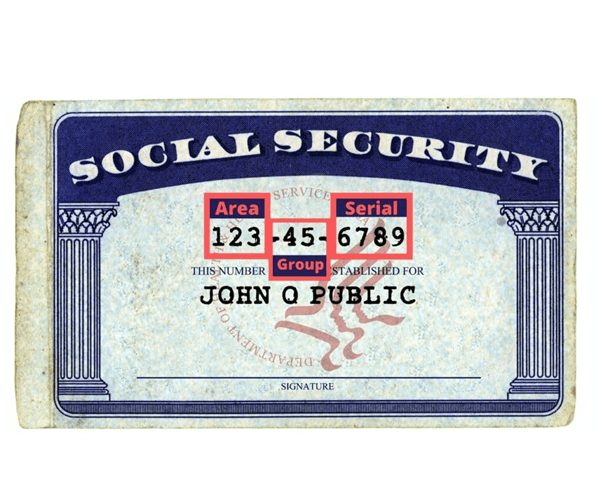

Tip 1: Memorize your SSN by heart

This is a prerequisite. If you have committed your SSN to your memory, you won’t be tempted to take it out or jot it down on paper, which could mitigate the risk of the information falling into the wrong hands.

Tip 2: Safeguard your SSN

Store your card somewhere safe in your home and don’t carry it around unless you absolutely need it. Also, don’t forget that your SSN may appear on other important documents – such as your health insurance card and the school ID card – so make sure they’re safely tucked away too.

Tip 3: Don’t share your SSN unless necessary

While it’s perfectly lawful for employers, banks, federal & state agencies, your DMV, and credit reporting agencies to collect your SSN, others may not provide legitimate reasons why they must use it.

If you’re ever in doubt, don’t be afraid toask questions: Why do you need my SSN? How will it be used? What happens if I don’t comply? What law requires me to hand over my SSN? Can I provide an alternative form of ID?

Tip 4. Protect your important documents

Paperwork such as pay stubs, tax returns, bank statements, and loan documents may include your SSN and other types of sensitive data.

- If you need to retain documents, make sure you encrypt them and secure them with a strong password.

- If you are to dispose of a physical copy, shred it instead of simply tossing it in the dustbin – identity thieves wouldn’t mind scavenging the trash can to gather your personal information!

Tip 5: Use an identity protection service

Although it may help to practice digital hygiene while you’re on the internet, if you’re not a DIYer, you could use Aura to take proactive protection from SSN-related identity theft.

Aura is a reputable identity protection service that’s dedicated to protecting you and your loved ones from online fraud and identity theft. It is indeed a 7-in-1 product to give you multilayers of protection:

- 3 bureau credit monitoring – Suspecting someone would open new accounts in your name or use your credits to take out loans? Don’t worry – Aura will be on your side. It will monitor your credit files on the 3 major credit bureaus and send you a real-time alert if suspicious activity is detected.

- Identity protection – It’s Aura’s job to protect your personal information online (registered SSNs, online accounts, etc.). If your information is compromised, you will receive an instant alert.

- Password Manager – Weak passwords may open the door for hackers to gain access to your accounts. To combat this, Aura makes sure to create strong passwords and secure them.

- Antivirus – Aura’s antivirus software gives you 24/7 protection from malware, ransomware, virus, and more.

- VPN – With Aura’s military-grade VPN, it’s only one step away to shop, browse, and banking securely and privately.

- Credit lock – You’re free to lock your Experian credit file to prevent your credit from being exploited.

- Family identity protection – Protect your family from financial fraud, theft, and other types of online threats.

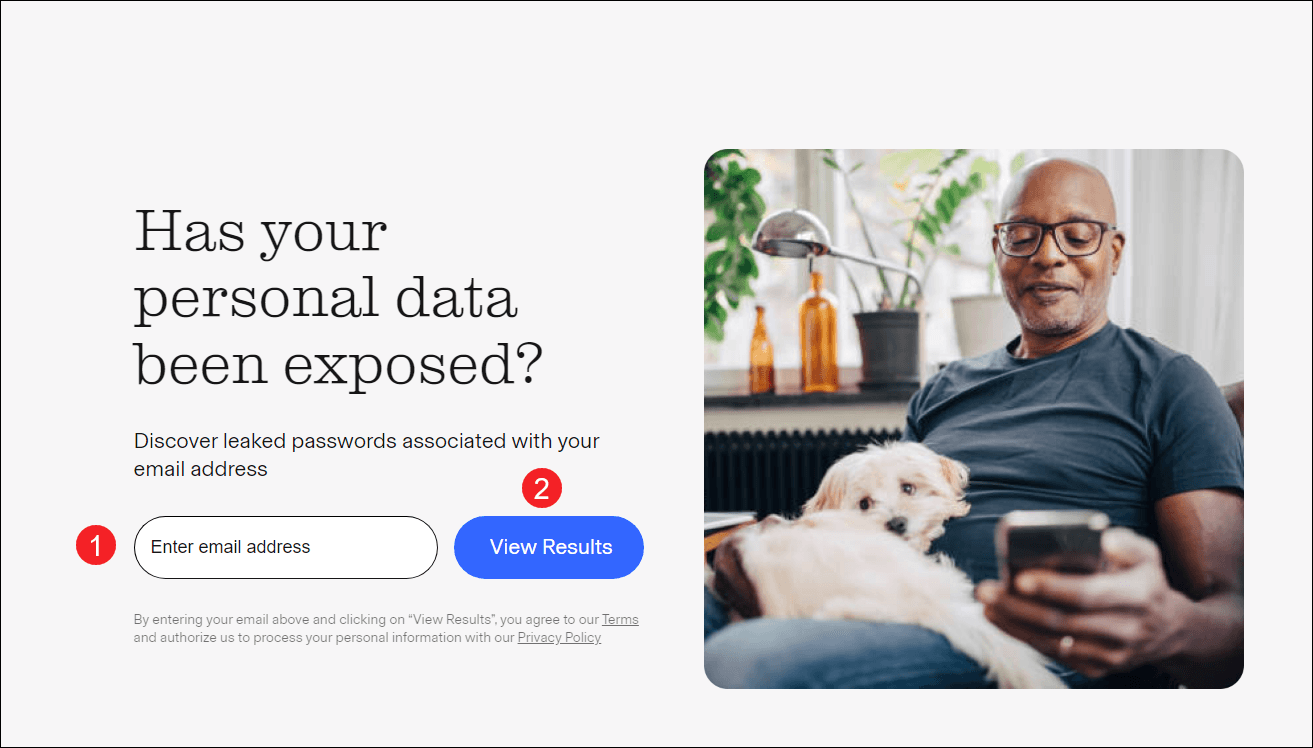

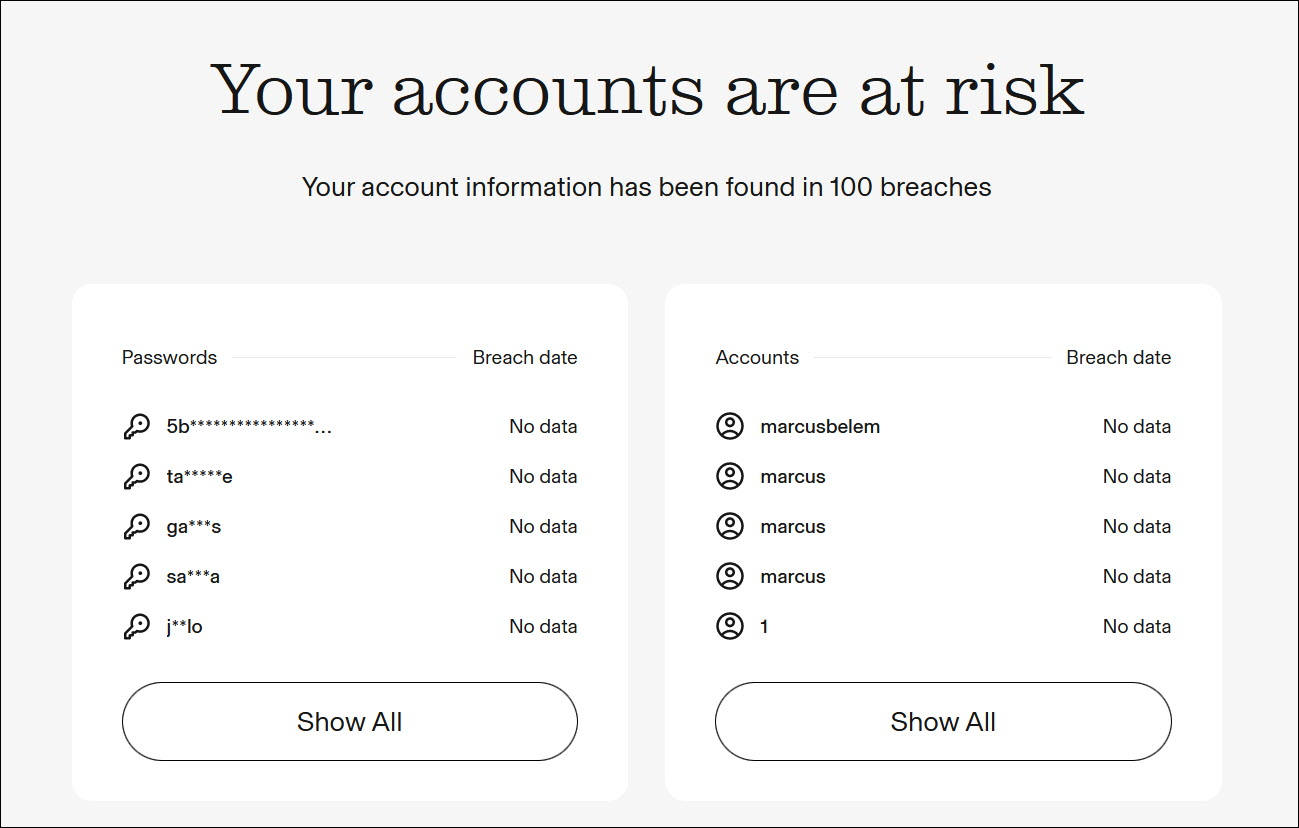

Here is how to use Aura to check if your personal data has been leaked (which could include your SSN):

- Go to the Aura Free Scan page.

- Enter your email address and click View Results.

- Aura will check if the information associated with your email address is being exposed in data breaches or ends up on the dark web.

- You can start the 14-day free trial to access the full report, along with its full toolset of identity protection.

Tip 6: Beware of phishing

Phishing is a type of identity fraud gimmick that has been in existence since the dawn of the internet. Attackers often pose as a trusted person or entity to send you malicious links, files, and attachments and lure you into giving out your SSN, password, credit card number, and other types of sensitive info. It could happen over the phone (text messages or phone calls) or on the Internet (emails, websites, etc.).

To protect yourself from falling prey to phishing, make sure to NEVER EVER give out your personal information – no matter how alluring or convincing it may sound – until you can confirm it is from a legitimate source. A lavish prize in a contest you never competed in? A big discount on an item you never purchased? Think carefully before you act.

Tip 7: Create an account on the Social Security website

It isn’t just adults, but child identity theft also shouldn’t be neglected. Just because your kids haven’t reached the legal age of applying for credits doesn’t mean malicious actors won’t target them. The Social Security Administration states that opening an account for your kid’s social security numbers will prevent someone else from targeting their accounts and gaining access to their benefits information.

Summary

Your SSN is like a honey pot for ID thieves. With a stolen identity, they could impersonate you to take out loans, drain your bank account, or even commit crimes, which could wreak havoc on your financial health and potentially leave you with legal trouble and tremendous emotional aftermath.

ID theft can go undetected for a very long time. In some cases, it isn’t until months or years when the victims notice suspicious fluctuations in their credits, receive calls from unknown bill collectors, or get denied for a mortgage that they realize their identity has been compromised.

With that all said, prevention is the best cure. In this article, we’ve put together 7 proactive tips you can equip yourself with to stay protected from SSN-related ID theft. Hopefully, it has helped.

If you have any ideas, questions, or suggestions, you’re more than welcome to leave us a comment below.

View all of Enya Zhang's posts.

View all of Enya Zhang's posts.