How to Check If Someone is Using My Identity | 2024 Guide

Has your personal data been leaked to the Dark Web?

Identity theft is when someone steals your personal details for financial gain. It’s a crime that could cost you a fortune and wreak havoc on your credit score. In 2021 alone, the Federal Trade Commission (FTC) received more than 1.4 million reports of identity theft.

Want to learn more about how to protect yourself, your family and your savings?

Table of contents

How to check if someone is using your identity

Identity theft normally happens in silence. If you’re not constantly checking to see if it’s happened, by the time you find out that it has, the majority of the damage will probably already have been done.

RECOMMENDATION: Our recommendation is to use an identity monitoring service like Aura or LifeLock. They can automatically track your information across the internet, and alert you if there is any suspicious activity involving your data. We talk more about both of these tools later in this article. Skip ahead…

If you’d prefer to manually check for identity theft, and you have the time and patience to do it regularly, below are the checks we recommend you conduct:

- Check your credit card and bank statements.

Spot any purchase or withdrawal that you didn’t make. - Review your credit reports.

AnnualCreditReport.com allows each U.S. consumer to check their credit report for free every 12 months (now weekly). Request the report from the site and look for accounts you didn’t open or inquiries you don’t recognize. - Track your bills.

If a regular bill suddenly stops coming, check if someone has changed your billing address. That’s a clear warning sign for identity theft. - Check if you’ve received any IRS notices.

The IRS will alert you if there’s more than one tax return filed in your name. - Review your medical bills and Explanation of Benefits statements.

In case of medical identity theft, you might notice suspicious items in the two documents.

Anything fishy might suggest the possibility of leaked and misused personal information. Stay alert even when there is none, because you might not be so lucky next time. Free check if your personal information has been leaked to the Dark Web>>

How to protect yourself against identity theft

As the old adage goes, prevention is better than the cure. This is certainly true when it comes to identity theft. That’s why more and more people are using identity protection services to avoid identity theft. Here are our top three recommendations.

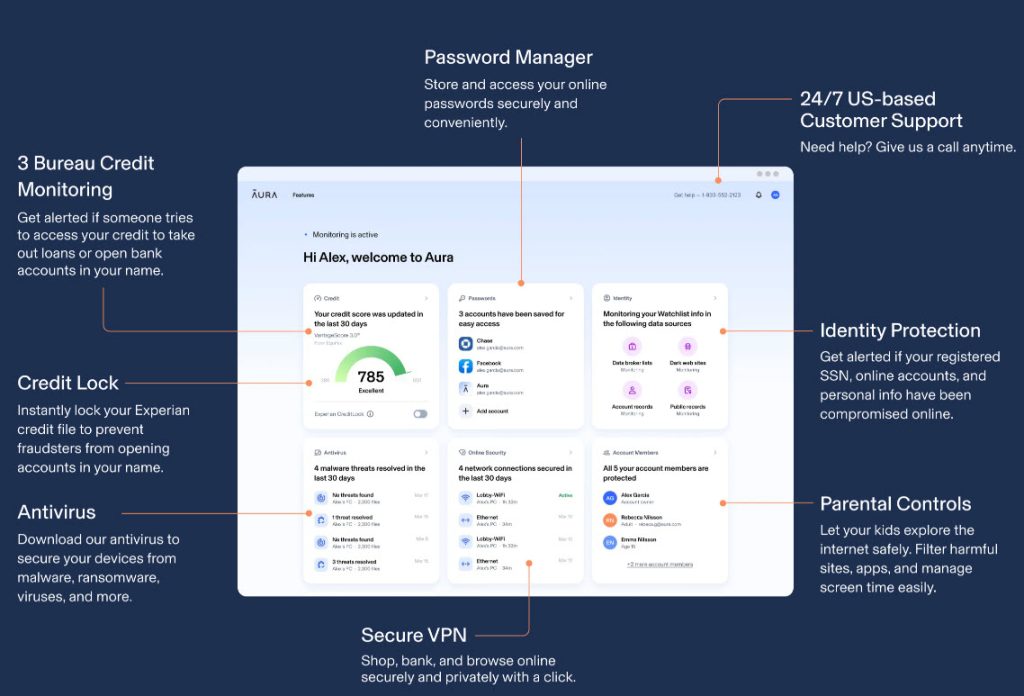

1. Aura

Comprehensive protection for the whole family.

Aura offers full-spectrum protection of your identity. It’s the #1-rated identity theft protection service, according to digital safety aggregators like Security.org.

- Prevention – Aura’s identity protection plans include cross-platform antivirus, a password manager, parental controls and a virtual private network (VPN). All of these features can prevent personal data from leaking, so as to stop identity theft. It also enables you to instantly lock your Equifax credit file to prevent fraudsters from opening accounts in your name.

- Detection – Aura monitors the ‘big 3’ credit bureaus and will alert you if someone tries to access your credit to take out loans or open bank accounts in your name. It can also alert you of any suspicious activity on your bank, retirement, and other financial accounts.

- Recovery – If the unthinkable happens, and your identity is stolen, Aura has you covered. It provides step-by-step recovery services. If you’re a subscriber of any of their plans, Aura’s U.S.-based White Glove Fraud Resolution team will create a remediation plan to help you recover your identity in case of a data breach.

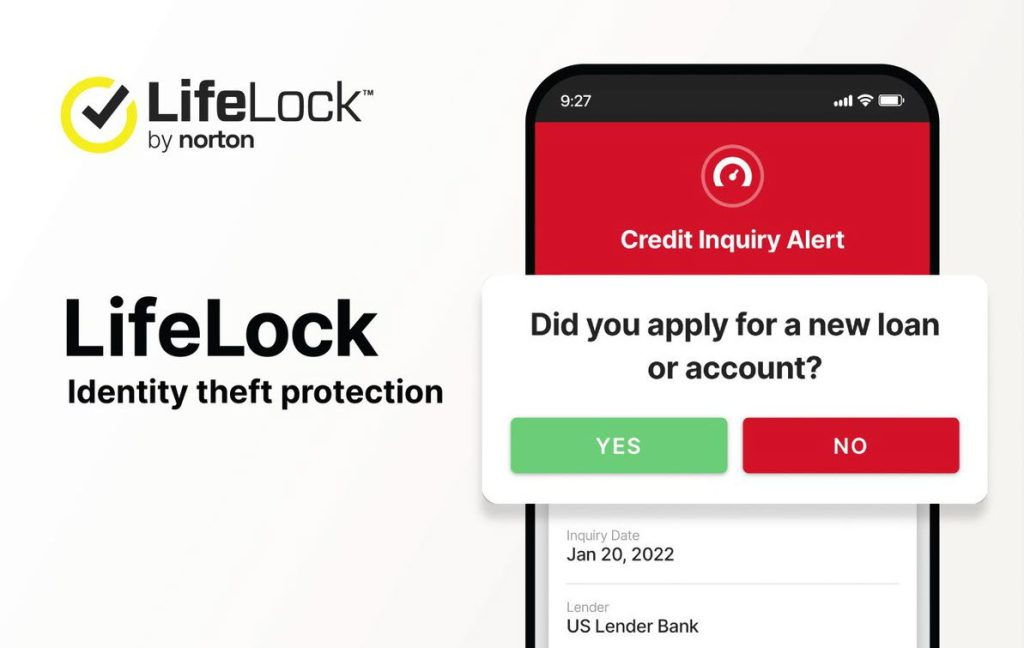

2. LifeLock

Proactively alerts you about possible identity threats.

LifeLock by Norton is another fantastic identity protection tool. Like Aura, it offers 360-degree protection.

- Prevention – Most LifeLock plans include device protection to weed out malware that can be used to steal your personal information.

- Detection – It closely monitors key areas where signs of identity theft might initially pop up, such as data breach notifications, USPS address changes, crimes registries, court records and Dark Web content. It then alerts you of any problems.

- Recovery – LifeLock will then take action to secure your identity and reimburse you for funds stolen.

One feature worth mentioning: LifeLock’s all plans have up to $1 million coverage for lawyers and experts, if needed, to help you fix identity theft. If your identity is stolen, a U.S-based Identity Restoration Specialist will work on your case from start to finish.

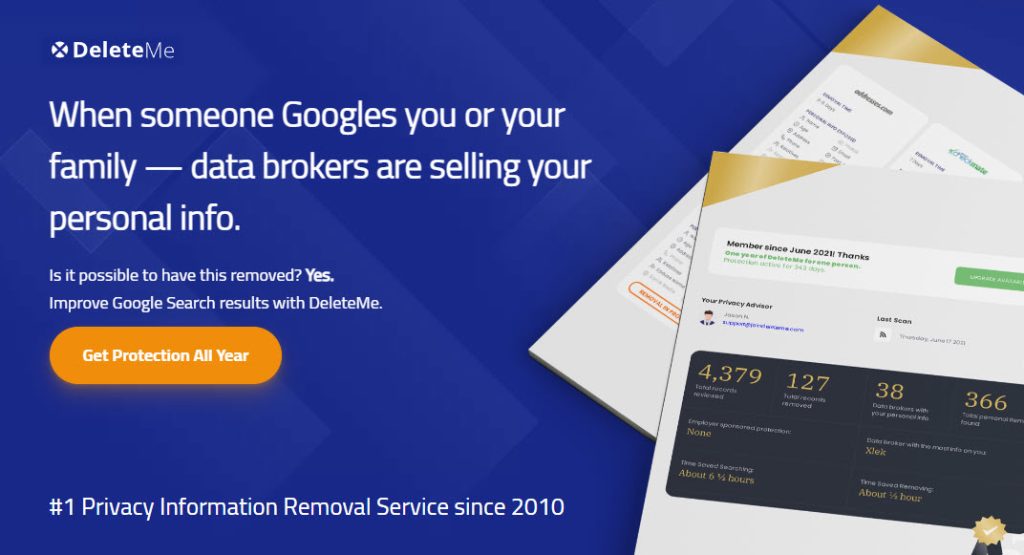

3. DeleteMe

Remove your online footprint easily.

One way of protecting yourself from identity theft is to limit the information that’s available about you online. No matter how careful you are, data brokers are really good at finding your personal information, and posting it online. There are hundreds – if not thousands – of people search sites out there, and most of them probably have some personal information about you published for all to see. It could be anything from your email address right through to your mother’s maiden name and the details of all your assets!

To fix that, you can try DeleteMe.

DeleteMe is a hands-free subscription service that removes your personal information, like name, address, age, phone numbers, and email address from data brokers online. This will reduce your online footprint and help keep you and your family safe.

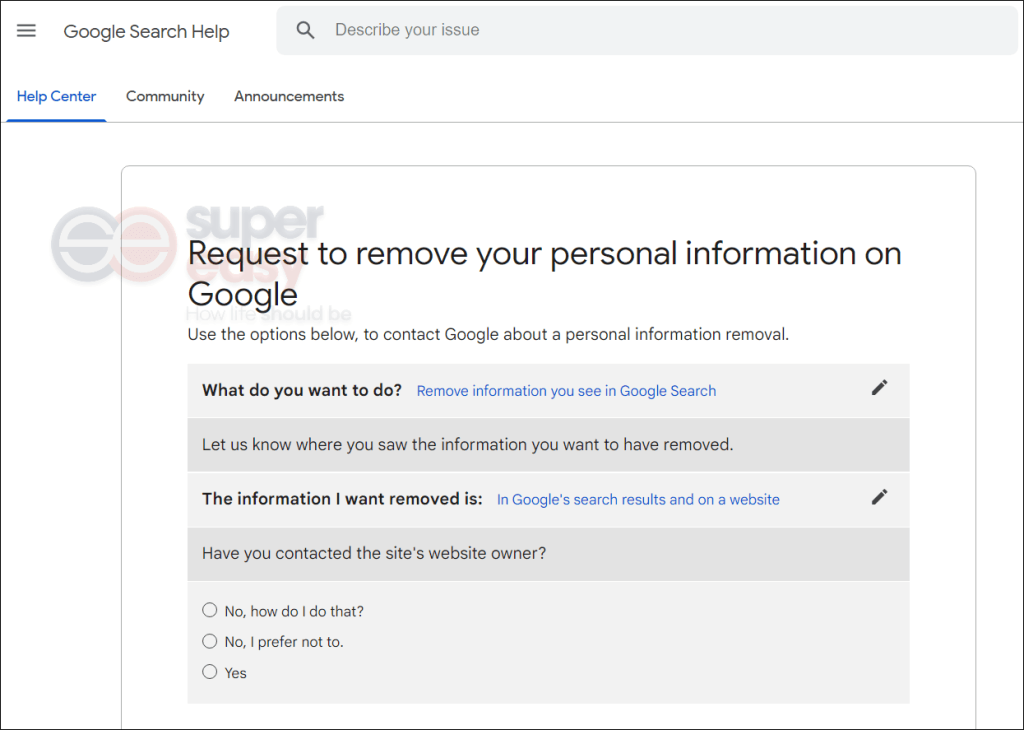

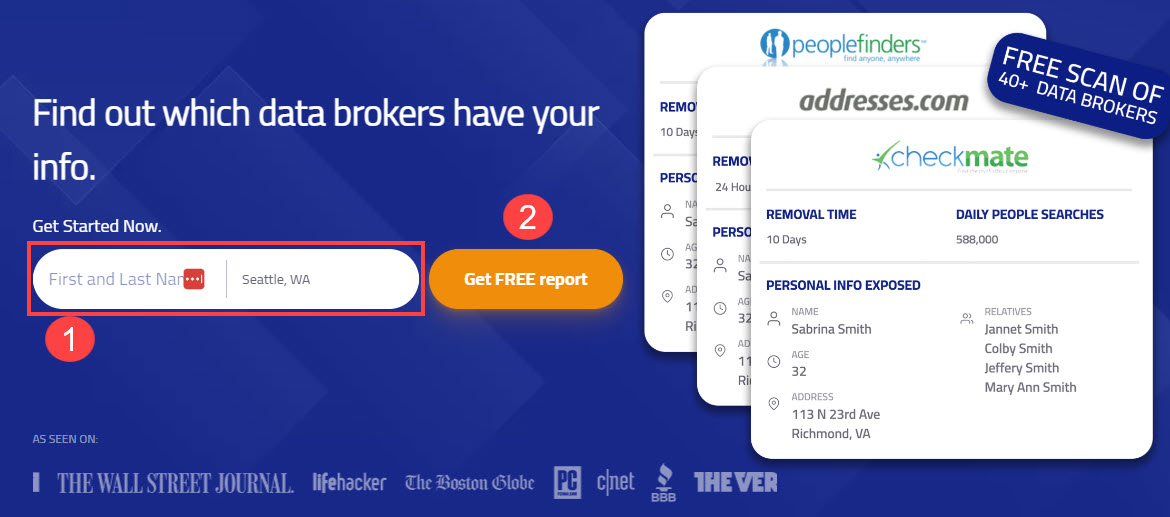

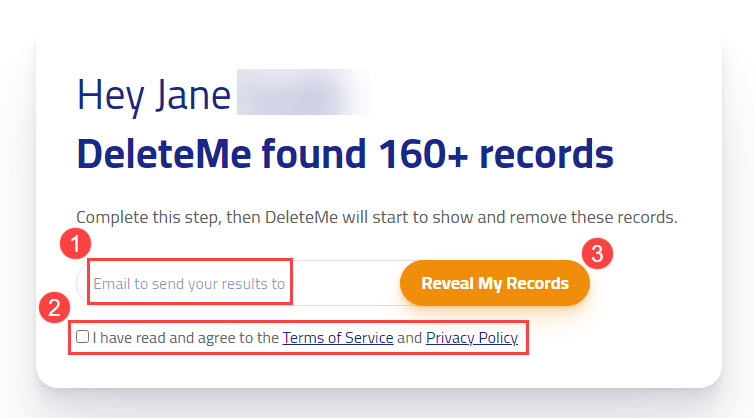

- Go to the DeleteMe search page. Enter your name and city, and click Scan FREE.

- Wait for DeleteMe to search all the people search sites. When it says it has found your records, enter your email address, click the consent box and click Reveal My Records. You’ll need a subscription to reveal your records and remove yourself from the sites that collect and post your information online.

Don’t forget common sense

Regardless of what tools you use, there are some data security practices you should always follow:

- Use secure passwords.

Use complex and unique passwords wherever possible. This will provide you with the best security. For online platforms, you can use a password manager, like LastPass, to create and remember your passwords for you. - Don’t respond to cold calls and emails.

An identity thief may contact you directly, to trick you into giving out your information. This scam is typically known as phishing. It’s best if you don’t respond to cold calls or emails at all (even if they claim to be from your bank). And don’t click links contained in unknown emails. - Collect your mail frequently.

Collect your mail every day, as soon after delivery as possible. Stolen mail could leak your personal information. - Protect documents that contain personal information.

Keep your financial records, Social Security number and any other documents that have personal information in a safe place. And when you no longer need them, shred them rather than throwing them in the trash. - Ask questions before giving out your SSN.

If any organization (e.g. a medical provider, a company, or your child’s school) asks for your Social Security number (SSN), be careful. Usually these sorts of organizations don’t need your SSN.

What to do if your identity has been stolen

If you use an identity protection tool like Aura or LifeLock, and your identity is stolen, you can relax. Everything will be taken care of for you:

- If you’re on any of Aura‘s plans, Aura’s U.S.-based White Glove Fraud Resolution team will create a remediation plan to help you recover your identities in case of a data breach.

- If you’re a LifeLock subscriber, LifeLock will take action to secure your identity and reimburse you for funds stolen.

If you don’t use an identity protection tool, and your identity is stolen, it’s critical that you act quickly to minimize any loss. The first thing you should do is call your credit card company and freeze all your accounts. Then you can call one of the three credit reporting agencies to place a fraud alert on your credit report:

Equifax: 1-800-349-9960

Experian: 1‑888‑397‑3742

TransUnion: 1-888-909-8872

You can also visit the official FTC website to get a complete checklist of what to do immediately and how to restore your identity.

View all of Arlee Hu's posts.

View all of Arlee Hu's posts.