How To Know If Someone Is Using Your Social Security Number

Social security number (SSN), the most important identifying information, is extremely vulnerable to thieves and hackers. If it’s stolen, scammers can apply for loans or credit cards in your name, take your tax return, medical coverage or other social benefits. So how to check if someone is using your social security number and better protect yourself against such SSN frauds?Here is an ultimate guide for you.

Protect your SSN and identity security with Aura

How to check if your SSN is stolen

Social security number theft can go undiscovered for years, leading to devastating financial loss, bad drop in credit scores and endless stress. But if you’re careful, there are some obvious signs when your social security number is being abused.

1. Check your credit report

The most effective way to see if someone has access to your SSN is to check your credit report, which will show a list of credit accounts opened in your name, your payment history, credit limits and other information. Any new accounts that you didn’t apply for, transactions you didn’t make or hard inquiries you didn’t request could be signs of identity theft and may result in a negative impact on your credit score.

You can get a free credit report from three major credit bureaus (Experian, Equifax, and TransUnion) every week through annualcreditreport.com.

2. Monitor your financial information

It’s wise to monitor your credit cards and bank account statements regularly. Social security number thefts have numerous ways to steal your money. Even minor charges or withdrawls may mean the thieves are testing if your account works. You could also sign up for text or email alerts for new transactions from your banking portal, an easy way to keep track of what’s happening with your money.

The lucrative tax refund is another motivation for criminals to steal your SSN. To detect if someone files tax refund under your name secretly, you could request a tax transcript online from IRS (Internal Revenue Service) and learn about all the recent applications.

Apart from IRS, you should also check the social security statement to see if someone claims your social benefits like unemployment payments. Inconsistent earnings require attention as well. If there’s an income from unknown employers, it’s likely that your SSN is used by others to get a job or pass a background check.

3. Review your mail

If you’re receiving mails from companies you don’t recognize, take it seriously. It’s possible that someone is signing up for the service or making transactions using your identity. Follow up on those records to see if something is wrong.

Another red flag of identity theft is that your regular bills or correspondence suddenly stopped delivering. Perpetrators may have secretly changed the mailing address.

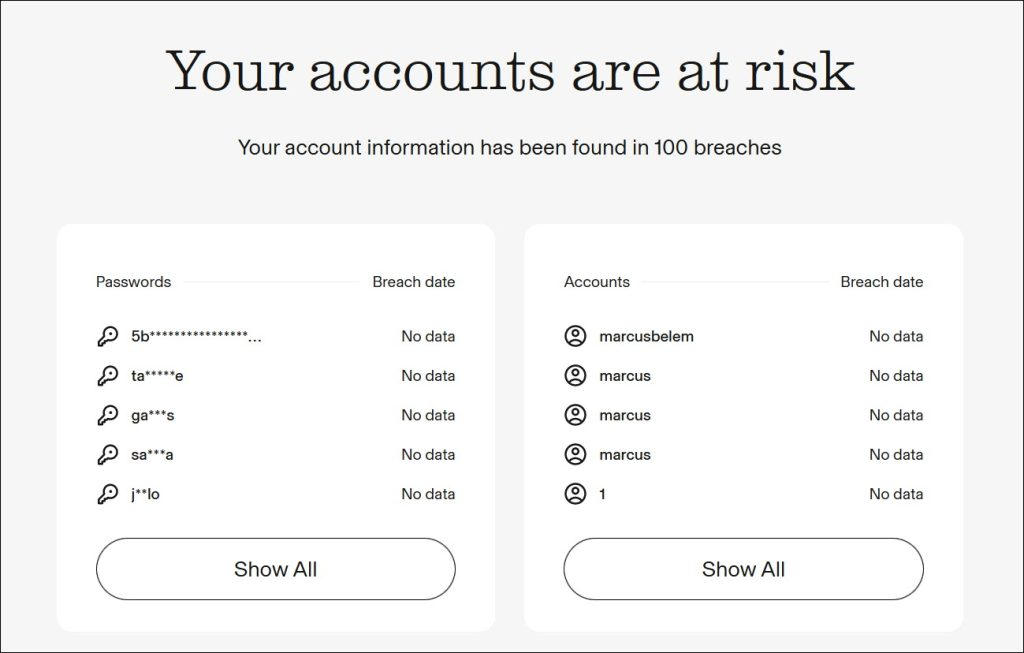

4. Run a dark web scan

Data breaches have been a common cyberattack where hackers steal valuable user data from the organizations and services you’re using every day. Large amounts of sensitive information such as phone number, email, bank account, or medical records were leaked and may eventually appear on the dark web, falling into the wrong hands.

Accessing the dark web requires encryption software and special browsers. But don’t worry. You can take advantage of a free scan tool to check if your information is exposed across the internet.

However, even if you find your information on the dark web, it’s hard to get it removed. And unfortunately, you won’t realize your identity or social security number is in risk until the fraudsters start using it. That’s why you should regularly review your financial records and stay aware of any changes.

If you don’t have time to track your digital safety, we recommend using a dedicated identity protection tool like Aura or Identity Force. They provide immediate alerts when someone tries to use your SSN or identity, and instantly lock your credit profile to prevent losses. They also keep a close eye on your credit, bank and investment accounts to ensure they are acting normally.

Aura – Top Identity Protection

![]() SSN & credit monitoring

SSN & credit monitoring ![]() Real-time fraud alerts

Real-time fraud alerts![]() Antivirus + secure VPN

Antivirus + secure VPN![]() Password manager

Password manager ![]() $1M identity theft insurance

$1M identity theft insurance

What to do with SSN fraud?

If you notice someone is using your social security number, you should take immediate action to avoid further losses. The faster you take action, the easier it’s to undo the damages.

1. Report the SSN theft to proper authorities

To secure your personal information and property when encountering identity theft, you should first turn to the proper authorities for assistance.

- SSA (Social Security Administration) – Contact SSA at 1-800-772-1213 or 1-800-325-0778 to request to block any automated telephone and electronic access to your SSN record.

- FTC (Federal Trade Commission) – Visit IdentityTheft.gov to report the fraud and you should get a step-by-step recovery plan.

- Local police – File a police report in the local jurisdiction and they should investigate the crime.

- Companies or organizations where the SSN frauds take place – You need to contact each company or business where the fradulenters use your SSN, such as a bank or medical institution, etc, so they can stop the use of your accounts.

2. Request credit freeze and fraud alert

Placing a credit freeze will prevent anyone from accessing your credit file and therefore, scammers won’t be able to apply for loans, credit cards or open new accounts in your name. To do so, you have to contact the three main credit reporting agencies one by one.

- Equifax: 1-800-525-6285

- TransUnion: 1-800-680-7289

- Experian: 1-888-397-3742

Alternatively, you could place a fraud alert. This will notify the credit agencies that you’re suffering from identity theft and ask them to take additional steps to verify the identity of someone trying to access your credit report. Simply request the fraud alert with one of the credit bureaus and the other two will also get notifications.

Professional & easy safety solution for whole family.

Conclusion

Social security numbers being stolen can be a stressful and frustrating experience. You’ll need to dispute fraudulent charges, and worst, if the incident destroyed your credit score, it may take months or longer to rebuild it. When those warning signs emerge, it’s usually too late. You’d better take precautions such as tracking your financial accounts, SSN and managing your sensitive information in safer ways.

View all of Brinksley Hong's posts.

View all of Brinksley Hong's posts.