Finding the assets of a deceased person is an important step in settling their estate and ensuring that their wishes are carried out. In this article, we’ll discuss in detail how to find the assets of a deceased person for free, including checking public records, inquiring with relevant parties and more.

Table of contents

Types of assets a deceased person may leave behind

Assets that a deceased person may leave behind can be categorized into different types, including:

- Real estate: Properties owned by the deceased, such as houses, apartments, land or commercial property.

- Financial assets: Bank accounts, investments (such as stocks, bonds and mutual funds), retirement accounts (such as an IRA or 401(k)), and life insurance policies.

- Personal property: Cars, furniture, jewelry, collectibles, and other belongings.

- Digital assets: Online accounts, such as email, social media, and cloud storage.

- Intellectual property, such as copyrights, patents and trademarks.

4 Best free ways to find assets of a deceased person

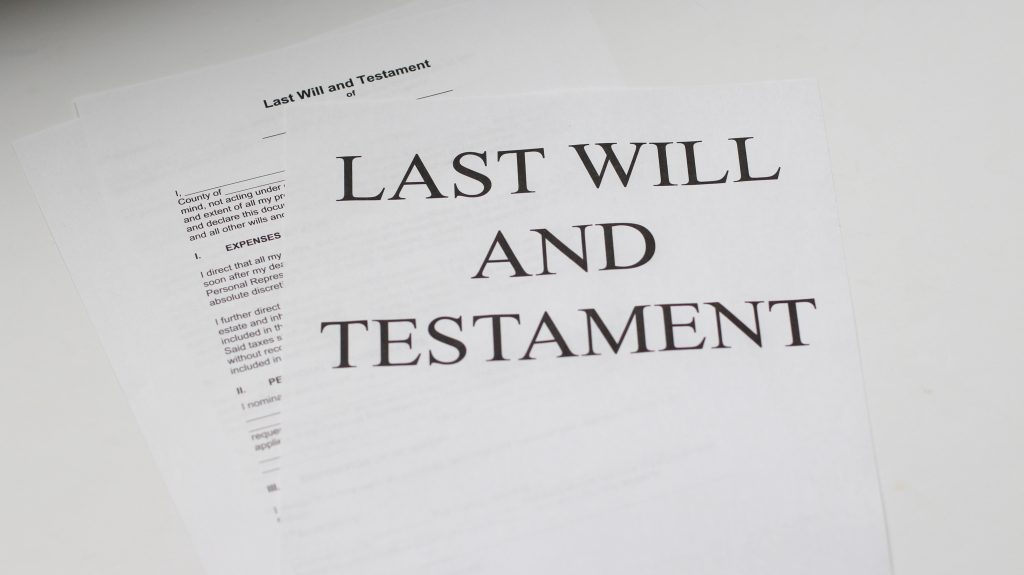

1. Look for a will

If the deceased person left a will, it will outline their assets and specifies how they wish them to be distributed. Sometimes, the deceased person may not have informed their loved ones about the existence of their will. If this is the case, it is necessary to locate their will or trust documents.

People tend to store their legal and estate planning documents in a secure location within their home. Such documents are often kept in an office desk or a file cabinet for easy access. If you are searching for the assets of a deceased person, it is recommended that you start by examining their personal papers to determine if they have a will.

Additionally, it is possible that the deceased person may have kept their will with an attorney or a financial institution for safekeeping. Therefore, it is important to check with these entities as well to see if they have a copy of the will or any other important legal documents that may be relevant to the estate.

2. Check with government agencies

Public records from government agencies can provide valuable information on real estate, property ownership, and any outstanding debts or liens against the property. However, it’s important to search multiple sources to ensure that all assets are accounted for. Listed below are some ways to check public records to find assets of a deceased person.

County Clerk’s Office

The county clerk’s (also called county recorders or register) office is a good place to start. They maintain records of real estate transactions, including deeds and property tax records. You can search for the property records of the deceased person by their name or property address.

Department of Motor Vehicles

If the deceased person owned a vehicle, you can check the Department of Motor Vehicles (DMV) for information on the ownership and registration of the vehicle.

Probate Court

If the deceased person had a will, it may need to be probated in court. The probate court will maintain records related to the probate process, including the inventory of the deceased person’s assets.

State Unclaimed Property Office

If the deceased person’s assets were not claimed after a certain period, they may have been turned over to the state unclaimed property office. You can check with the state office to see if there are any unclaimed assets in the deceased person’s name.

Secretary of State

The Secretary of State’s office in the state where the deceased person lived or owned a business may have records of their business registrations, licenses, and permits.

Social Security Administration

The Social Security Administration may have records of the deceased person’s Social Security benefits and any outstanding payments or debts.

Bankruptcy Court

If the deceased person filed for bankruptcy, the bankruptcy court will have records related to their assets and debts.

3. Check financial documents

It is important to look for bank statements, investment accounts, insurance policies, property deeds, tax returns and any other financial documents that may provide information on assets. Check the deceased person’s mail and files for any records of financial accounts, investment portfolios, or other assets. Keep in mind that some people may have had accounts in multiple banks or with different financial institutions. Make sure to review all financial documents to identify any accounts that may have been overlooked.

If you can’t get any clue from financial documents, then try contacting the banks, credit unions, and other financial institutions where the deceased had accounts. Ask for information about any accounts in the deceased’s name, including checking accounts, savings accounts, retirement accounts, and investment accounts. You may need to provide a copy of the death certificate to obtain information about the accounts.

4. Ask other family members and friends

Relatives and friends of the deceased person may have information about assets that are not documented in any legal or financial documents. For example, a family member may know that the deceased person had a valuable piece of jewelry or a friend may know that they owned a vacation home in another state. Additionally, family members or friends may have access to the deceased person’s personal papers or computer, which could contain important information about their assets.

Other people who are familiar with the financial situation of the deceased person could also be a valuable source of information. For example, the deceased person may have had a financial advisor or accountant who can provide information about their financial assets, such as bank accounts, investments, and retirement accounts.

If you can’t find the info through free methods…

If you’re unable to find assets of a deceased person through free methods, it may be worth considering paid professional public records search engines, as they can greatly increase your chances of finding the information you want. Also, it may require considerable time and effort to search through public records and locate the relevant information manually. If you prefer searching hundreds of official public databases in one single place, paid tools like BeenVerified can be of great help.

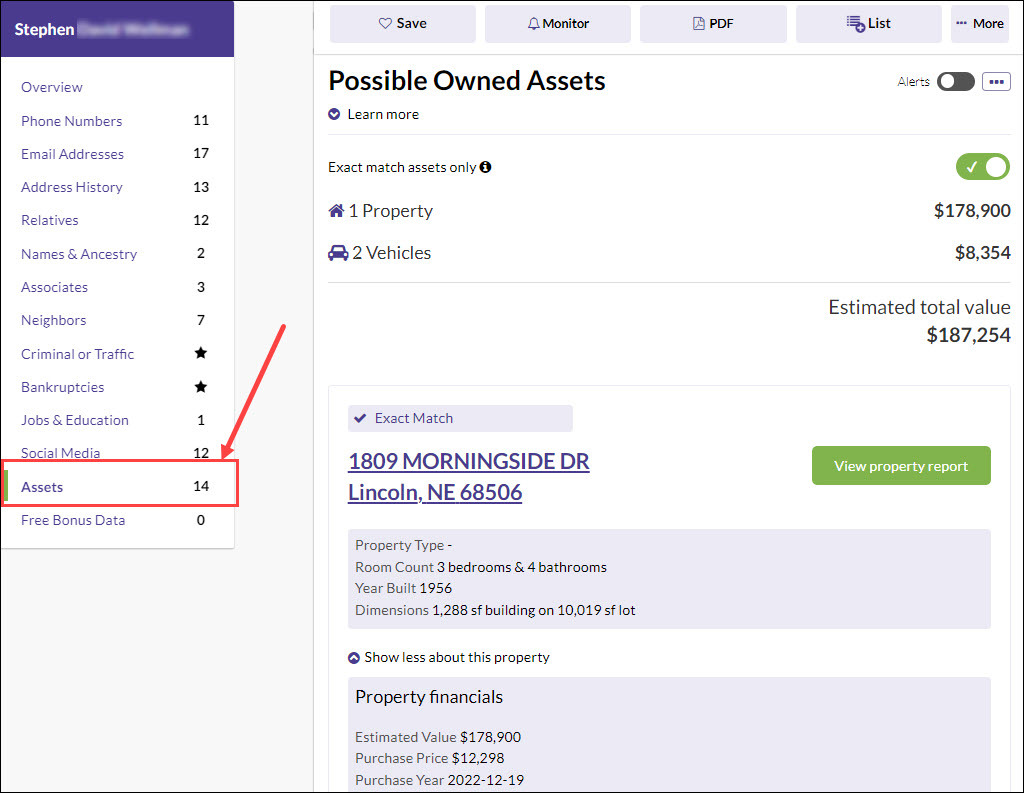

BeenVerified is an online public records search engine that can be used to access a wide range of public records, including property records, criminal records, and more. Once you input a name, BeenVerified will generate a detailed report on the person, including all the assets they may have owned.

- Go to the BeenVerified public records search page.

- Enter the full name of the deceased person into the search box and click SEARCH.

- Wait for BeenVerified to comb through its database. Once you find your match, click to view the detailed report. From the Assets section, you may be able to see the assets that the person owns, such as property, vehicles, aircraft and watercraft. It also indicate estimated values of the assets.

What is “unclaimed money”?

Unclaimed money, or unclaimed property as it’s also called, refers to funds or financial assets that have slipped into dormancy, forgotten in the corners of bank accounts. When someone dies, these hidden streams of wealth can remain unclaimed, especially if heirs or beneficiaries are unaware of their existence.

In such cases, financial institutions act as responsible caretakers, reporting unclaimed assets to the state treasury. This net gathers not just bank accounts but also uncashed paychecks, forgotten insurance policies, stocks, and more. The state then becomes the temporary guardian of these lost treasures, patiently waiting to reunite them with their rightful owner, or in this case, their rightful heirs.

Remember that unclaimed money doesn’t simply vanish into thin air. It’s not a phantom fortune, but a tangible legacy waiting to be claimed. It might be the means to alleviate financial burdens during a difficult time, the helping hand to ensure final expenses are met, or even the opportunity to fulfill the deceased’s wishes through a generous charitable donation. So, while grief may cloud the way, remember to look for the hidden pockets of light. Explore the resources available, delve into the possibilities, and let the unclaimed assets find their way back home.

Bonus Tip: how to avoid unclaimed money

You may have realized that searching for assets of a deceased person can be a difficult and frustrating task, and it can be a significant loss if money remains unclaimed.

Imagine your loved ones navigating the financial maze after you’re gone. A tangled web of forgotten accounts, misplaced investments, and unclaimed assets. But there’s a way to avoid it. A secret weapon called an estate plan. Think of it as a treasure map, guiding your heirs through the financial landscape after you’ve set sail for uncharted waters, ensuring every last penny finds its rightful place – not in the state’s coffers, but in the hands you hold most dear.

Creating an estate plan might seem a complex process, but you don’t have to go it alone. Reputable online legal services and experienced estate planning attorneys are your trusted allies, helping you craft a plan that’s comprehensive and legally sound.

Contributors

Operations Engineer